Sense of urgency enters Melbourne property market

Not only has the market remained strong since resuming after Easter, there is now a renewed sense of urgency from buyers who feel that if they don’t buy now, they might miss out altogether.

On weekends just gone, we have seen clearance rates reported around the 75-80% mark. The number of properties on offer is lower, no doubt, yet these figures do indicate that the market is currently in favour of the seller.

Increasingly, for the good properties, offers are being made before auction, processes are competitive and some of the results are difficult to comprehend. There are a few softer results, yet these are for the lesser quality properties or those which have not been initially overquoted or not marketed well by an experienced local agent.

How long the strength in the market will last is hard to tell. A sudden increase in stock levels, combined with more interest rate rises, and the market could turn back just as quickly, or, as we have seen before, a continued tightening of stock levels. Sellers that can hang on will, as the costs associated with buying and selling in the market are higher than we have ever seen. It appears to us the average tenure of home ownership is increasing rather than decreasing.

It’s not a new phenomenon in any market, but it seems buyers are still more sensitive around price than they were 18 months ago. And many are sitting on the sidelines, with the belief the real ‘bargains’ will come in spring or even next year.

Sometimes a vendor just gets lucky, such as 67 Hope Street South Yarra, where the vendor had two neighbours vying for the keys, pushing the price around $2 million above the expected price for the property. Unfortunately, that doesn’t mean that the next similar property down the road will achieve the same result.

But there are markets within markets. If we look coastal, a suburb such as Ocean Grove is not faring anywhere nearly as strongly as it did, with around four times the amount of the property for sale (a great majority of this is off-market) than this time last year. The reason? Living in a ‘lesser’ COVID world makes the location not as attractive as it once was, with many people returning back to the office and the ‘Melbourne’ way of life. Increased interest rates/land tax payments on investment / second properties is also having an impact, making such properties a burden rather than the safe haven they once were.

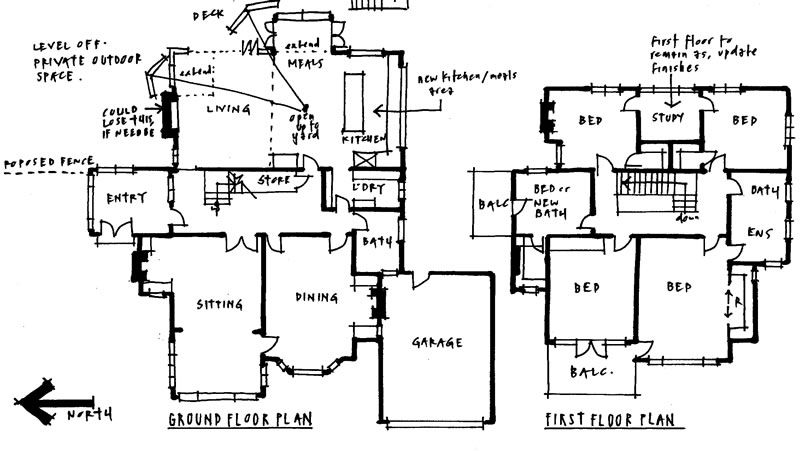

There also appears to be a swing back to ‘land sales’, with buyers having a renewed confidence in building new or developing. The shortage in housing stock and government initiatives to lift this have helped in this way. We don’t see the same level of confidence in homes requiring renovation. This could be due to increased costs in materials/fixtures etc and the shortage of tradespeople to do the work.

For buyers, we believe due diligence remains important. This includes considering not just how the property will suit you now but also its future potential as well as any limitations it may have, for you and if you were to sell it in the future.

If the property meets your needs, then it’s still the right time to try and buy it. There is no right market: we believe it is about buying the right house.

Some of the better properties currently on the market; an architect’s view

6 Stanley Street South Yarra – Carla Fetter/David Sciola, Jellis Craig

12 Warburton Road Camberwell – Geordie Dixon/Peter Vigano, Jellis Craig

22 Crisp Street Hampton – Angus Graham/Nick Sinclair, Hodges

‘Off-market’ Properties:

- Period family home, 4-3-3, pool, ~906sqm, Toorak – circa $5.5m

- DF single level fully renovated Victorian, 4-2.5-3, ~500sqm, Prahran – circa $5m+

- Cal Bung, 4-2-2, pool, ~863sqm, Camberwell – circa $2.7m

- Edwardian Family home, 4-2-1, north rear, ~930sqm, Balwyn – circa $3.6m

- Single Fronted Victoria, 2-1, west rear, ~197sqm, Prahran – circa $1.6m

- Brick Edwardian, 2-1, ~170sqm, Prahran – circa $1.3m

- Family home w basement, 5-3.5-3, ~780sqm, Brighton – circa $6.1m

- Contemporary single level, 5-2.5-2, pool, ~960sqm, Brighton East – circa $5.2m

- TH w basement, 3-2.5-2 plus study, Brighton East – circa early $2m

- Updated TH 4-2-4, bay views, near amenities, Sandringham – circa early $3m

- As new modern large family home, 5-4-4, pool, Sandringham – circa $4.6m

- Updated 80s home, 3 bed plus study, ~650sqm, Beaumaris – circa $2.35m

- Land to develop, ~890sqm, corner, NE rear, Beaumaris – circa mid $2ms

- Period weatherboard, 3-2-2OSP, renovated, Bentleigh – circa $1.8m

Auction Spotlights:

A crowd of close to 50 people witnessed the Jellis Craig auction of 42 Westbourne Street Prahran. 2 strong bidders fought it out for a well presented single fronted light filled freestanding Victoria, offering 2 beds, 2 baths, 2 living areas and off-street parking. A tightly held pocket in Melbourne’s southeast, within walking distance to the Hawksburn Village. Bidding started slowly, but soon became a race in two eventually selling for $1.845m. (Quoted $1.6m-$1.76m, called on the market at $1.760m)

The fundamentally single level 3-4 bed, 2 bath, DLUG home at the rear of two at 194a Bluff Road Sandringham, offers flexibility for both families and downsizers. Well oriented for north light, the home has been updated, yet offers further opportunities over time if desired. Quoted at $1.7-1.75m the auction attracted a good crowd and plenty of hopeful bidders. 4 mainly young family bidders quickly pushed the price to $1.9m where the home was called on the market. First one and then another downsizer entered the action and with clearly deeper pockets eliminated the original bidders. Another 30 plus bids eventually saw bidder 6 outlast all others and secure the property for a strong $2.21m.

Tight stock levels: are you ‘buy ready’?

One may be mistaken for thinking that, since Anzac Day, it is the first weekend out of lockdown again, with queues of potential buyers lining up for up to 15 minutes before scheduled open times to inspect the available properties over the past two weekends.

Stock levels have tightened even further.

Vendors are now even less prepared to sell before they have purchased for fear of being homeless as the number of available rental properties continues to decline.

While there has been much talk about landlords opting out of property investment as a result of the changes to minimum rental standards and increased service checks, a less discussed reason could be the number of properties in tourist locations that have been converted to ‘Air BNB’ as the weekly/daily rents. Particularly during peak times, these can be higher than a permanent rental, as well as providing the owners with opportunity to use the properties themselves.

Where Australians have had the property market predominantly to themselves since Covid, the demand from internationals is growing. In particular, Chinese buyers, as a result of China re-opening their borders for travel out of the country, are increasingly active and making the most of the low Australian dollar.

Significant increases in the number of people migrating to Melbourne is also adding stress to both the rental and buying markets; however, the news out last week that the government may reduce the anticipated migrant numbers entering Australia is a step forward, although this is unlikely to have much impact on demand in the short term.

Word on the street, speaking with agents across some key councils (Boroondara, Stonnington and Bayside) have advised that they are speaking to a lot of vendors considering selling, but they are not prepared to commit to a campaign until at least August or September this year.

With demand increasing weekly and the low stock levels, competition is likely to increase in the short term for the good properties.

Competition for the good properties is as strong as ever. As a buyer, are you prepared for this and have you undertaken the proper due diligence and homework required for what you are buying? Missing the right property now could mean a wait for several months until you get the chance again to buy, and what will the market be like then?

Highlights – some sales from the week where buyer competition pushed results well above quoted levels;

30 Aintree Road Glen Iris, quoted $1.6-$1.7m – sold $1.976m

84 Harp Road Kew, quoted $2.35-2.85m – sold $3.040m

3 Scotch Circuit Hawthorn, quoted $1.2m-$1.32m – sold circa $1.45m

45 Victoria Road Hawthorn East, quoted $2.6m-$2.85m – sold $3.340m

1/19 Bertram Street Elsternwick, quoted $1.55-1.7m – sold circa $1.85m

12 Brown Street Brighton East, quoted $3.4-3.7m – sold $4.5m

120 Dendy Street Brighton East, quoted $2.9-3.19m – sold $3.675m

37 Kendall Street Hampton, quoted $1.7-1.8m – sold $2.03m

Some of the better properties currently on the market; an architect’s view

7 Sheridan Court Brighton – Guy St Leger/Tom Davidson, Buxton

38 Chrystobel Crescent Hawthorn – Mike Beardsley/Ellie Morrish, Jellis Craig

9 Central Park Road Malvern East – Andrew Hayne/Justin Krongold, Marshall White

‘Off-market’ Properties:

- Modern architectural home, 4-3-2, ~700sqm, pool, Brighton East – circa $6m

- Single level 3-2-2, ~410sqm, Brighton East – circa 2.2m

- Period weatherboard, water views, ~460sqm, Brighton – circa $2.5m

- Upside down TH, Bay views, 4-3-2, Brighton – circa $4.5m

- Contemporary 4-3-2 family home with pool, ~560sqm, Brighton – circa $4m+

- Single level Edwardian on ~830sqm looking for update, Sandringham – circa $3m

- Modern 3 level w lift, 4-4-3, Bay views, Black Rock – circa $6.5m

- Period 2 storey 4-2.5-2, ~700sqm, Caulfield North – circa $3.3m

- Renovated single fronted Victorian, 3-2.5 home, Kew – circa $3m

- Two storey renovated Victorian, 4-2-2 car, ~371 sqm, Malvern – circa $3.5m

- Two storey Art Deco family home, 4-2.5-3, ~900 sqm, Malvern – circa $6.5m

- Edwardian family home, renovated, north rear, ~400 sqm, Malvern – circa $3.5m

- Single fronted Victorian, 3-1, ~143 sqm, Windsor– circa $1.8m

- Family home, 4 beds, ~917 sqm, Kew – circa $4.5m

- Brick Victorian family home, 4-2-2, west rear, ~566sqm, Malvern – circa $3.6m

- Renovated Victorian, 4-2-2, pool and studio on ~795sqm, Armadale – circa $6.5m

- Free Standing Edwardian, 4-2-1, Prahran – circa $2.8m

- Renovated, single fronted semi-detached, 3beds, 2 car, ~380 sqm, Malvern – circa $2.5m

- Renovated Victorian cottage, 2 bed, 1 bath, ~130sqm, Prahran – circa $1.4m

- Low maintenance townhouse, 3-2-1, Armadale – circa $2.2m

Auction Spotlight:

David Sciola and Carla Fetter head up the Jellis Craig team at 30 Aintree Road Glen Iris

30 Aintree Road Glen Iris delivers a well presented single fronted Victorian with 3 beds, 1 bath and a study. Open plan family and dining room, as well as offering a flexible studio and workshop at the rear of the property. This could be converted into parking if desired via the ROW (STCA). The auction attracted a large crowd of both downsizers and young couples on a cold winter’s day. Quoted $1.6-$1.7m, auctioneer David Sciola of Jellis Craig managed the bidding from 5 bidders. It was opened at $1.6m, quickly getting to $1.71m where it was put on the market. The home eventually sold for $1.976m. A strong result for the area.

Multiple factors impacting Melbourne property market

The more recent trend toward buyers preferring the ready-to-move-into homes over the ‘renovator’s delight’ or new build sites is potentially here to stay and we are noticing more and more buyers are prepared to pay a premium for it.

Another major player in the new build arena collapsed last week, leaving around 1500 clients unsure of their futures. This is likely to encourage more buyers to purchase an existing home, rather than land to build, increasing demand on a market already in low supply.

While land has always been considered the key factor in underpinning property values in Melbourne, the current trend to buy ‘turn key’ established homes suggests that this could be becoming as important, if not more important, than the land on which it sits.

Since the Covid lockdowns, Victorians have put more focus on what is important to them – for themselves, for their families, for their well-being and for their comfort.

The home has taken on a new meaning. It is not just a house for after hours and somewhere to sleep at night. It has become our sanctuary, our work place, our school space, our castle and our kingdom.

While position is still important, perhaps even more important now is the house itself. We have seen this trend strengthen as the building industry suffers collapse after collapse, diluting the confidence of buyers who are quickly realising the increased value of a home they can live in straight away.

Current issues we see influencing the market as we move toward winter include:

- Strong competition for ‘turn key’ homes if stock remains low.

- An increase in land / new build sites as some vendors no longer have the appetite or the budget to build.

- Fewer buyers interested in purchasing properties that need major works or replacing.

- Land tax increases pushing some vendors to sell.

- Landlords unable to afford to improve properties to meet minimum requirements for rental properties being pushed to sell.

- Demand increasing for rental properties – local demand and from migrants. Some people are now being forced to buy, rather than rent.

- More international buyers returning to the market.

- Agents moving toward more EOI (expression of interest) campaigns to manage the sales process, providing less transparency for buyers.

- Low Australian dollar making housing more affordable for overseas buyers.

- Construction workers continuing to choose less financially risky alternatives (many have made the switch to large government builds); therefore, fewer skilled trades available for private builds.

- Building costs to remain high while trades are in short supply.

- Low stock cycle to continue – many vendors won’t sell until they have bought, but can’t find anything to buy because stock is so low.

With a number of agents saying vendors want to wait until Spring before considering their next move, buyers should understand what they’re looking for and where it sits in the market. This will mean they don’t miss their opportunity to buy, as it could be a while waiting for the next opportunity to come around.

Highlights – ready to move into homes and homes that could be updated, but don’t need to be straight away:

- 14 Motherwell Street Armadale – well located, two bedroom townhouse (all bedrooms upstairs) – 5 bidders – $1,562,500

- 9 Daly Road Sandringham – original ‘Inform’ home, good floorplan, walk to most amenities – 5 bidders – undisclosed over $2,700,000

- 5 Ardrie Road Malvern East – neat period home, well positioned on block, north rear – 4 bidders – $2,330,000

- 22 Gilsland Road Murrumbeena – good location, north rear, single storey home with garaging – 4 bidders – $2,110,000

- 24 Bent Parade Black Rock – newer build home with pool, great location – 3 bidders – $3,920,000

- 4 Lyndhurst Crescent Hawthorn – good family home – 3+ bidders – $4.110m

- 11a Mayfield Avenue Camberwell – single level villa unit, close to amenities – 3 bidders – $1,245,000

Some of the better properties currently on the market; an architect’s view

41 Victoria Road North Malvern – Andrew James/Michel Swainson – Belle Property

28 Miller Grove Kew – Andrew Gibbons/Shamit Verma – Marshall White

13 Lileura Avenue Beaumaris – Noel Susay/Adam Gillon – Buxton

‘Off-market’ Properties:

- Californian Bungalow, 2 storey, pool, north rear, Hampton – circa $3.4m

- Modern family home, 4-3-5, pool, west rear, Brighton – circa $11.5m

- Beachfront ground floor apartment, 3-3-2, ~240sqm, Brighton – circa $7m

- Extended period home, 4-3-3, ~720sqm, east rear, Sandringham – circa mid $2m

- Fully renovated semi-attached, 2 storey, 4-3-2, ~400sqm, Brighton East – circa high $2m

- Single level townhouse, 3 bed, DLUG, west courtyards, Brighton East – circa early $2m

- Fully renovated single level Cal Bung, 3-2-2, north rear, Brighton East – circa high $2m

- 2 storey upside down TH adjoining golf course, 3-2.5-3, Beaumaris – circa early $2m

- Double storey brick family home, 5-3-2, approx. 970 sqm, Malvern East – circa $4m

- Edwardian family home, 5-2-2, approx. 1,388sqm Hawthorn – circa $6.5m

- Townhouse, 3,3,2, tandem garage, Hawthorn East – circa $1.45m

- Cal Bung 5,3,2, in need of renovation (STCA), approx. 875sqm, Camberwell – circa high $3m

- Renovated Edwardian cottage, 4-2-1, approx. 283sqm, south rear, Hawthorn East – circa $2.2m

- Landmark home, 5-4-4, ~3,080sqm, court & pool, Canterbury – circa $10m

- Single level period home, renovated, 4-2-2, walk to trains, Malvern – circa $4m

- 2 storey dated renovation Californian Bungalow, Malvern East – circa early $4m

- Renovated modern home 5-3-2, pool, Armadale – circa $9m

Auction Spotlight

The single level 3 bed, 2 bath, garage and 2 living zone property at 63 Fewster Road was always going to attract a range of buyers. The crowd attending was a mix of downsizes, as well as young couples looking to get into the Hampton area. While the home is looking for an update, this could be done over time. The quote of $1.1-1.15m was an attractive proposition for buyers. Adam Gillon headed up the Buxton team on auction day, quickly receiving a $1.0m opening bid. 4 bidders joined in the action, quickly pushing the property past its reserve and eventually selling for $1.257m. A sound result for what was on offer.

Uncertainty for now: how long will this last?

Teamwork is important! WoledgeHatt enjoying a round of golf together.

Good properties performed well on Saturday, with multiple bidders, and some had solid results.

A number of quality properties have also hit the net over the past couple of weeks and buyer numbers over the weekend were plentiful. One agent quoted 45 groups through in 22 minutes for a property in South Yarra.

There were a number of homes that sold above their quotes on the weekend (see a sample in our highlights below); however, there were also a large proportion that sold within their quoted range. The REIV clearance rate sat at 76% at the end of the evening.

If a property has problems or is incorrectly quoted, it can sit without interest indefinitely. If the quote was the problem, a number of these homes are now selling as vendors have reduced their expectations to meet the market.

While we continue to see good homes sell well (sometimes very strongly) in the current market, if a vendor’s expectations are well above what makes sense, they are likely to encounter resistance from buyers and may be better to wait before selling rather than damage their campaign from the outset and spend the rest of the time playing catch up trying to re-engage buyers.

With a tenth consecutive interest rate hike likely (at the time of writing), such uncertainty is certainly putting a cloud on the market. If as a buyer your pre-approval is about to run out, you may find your borrowing capacity is reduced. Those that are ‘buy fit’ right now are at an advantage, yet stock levels remain tight. When is the right time to buy? We have always said that the right time is when the right home to live in for the longer term becomes available, as predicting the future is very hard.

A number of agents are starting to comment that vendors are now talking about Spring. This may suggest that the volume could remain tight right through until August/September. If the number of people attending inspections is anything to go by, this could mean some serious competition for properties marketed and priced correctly.

Highlights:

- 13 Central Avenue Black Rock – approx. 470sqm with a fairly original, single storey 80s home on it, quoted $1.5-1.6m, sold for $1.7m, five bidders

- 1 Courang Road Glen Iris – comfortable period family home, could be further improved, quoted $2.3-2.5m, sold for $2.7m, three bidders

- 19 Earlsfield Road Hampton – turn key large modern home close to schools but a bit further to shops/station, quoted $3.6-3.7m, sold for $3.84m, three bidders

- 122 Cochrane Street Brighton – scheduled for auction 23rdMarch has sold beforehand. Quoted $2-2.2m, sold well above for an undisclosed figure toward the mid $2m mark

- 25 Finch Street Malvern East – large single storey period home, comfortable as is but could be further improved over time, quoted $6-6.6m, sold for $6,666,666

- 26 Mount Pleasant Grove Armadale – renovated, single storey Victorian terrace, quoted $1.5-1.65m, sold for $1.805m

- 10 Evelina Road Toorak – two storey Victorian Terrace, renovated with a bedroom/bathroom option downstairs and excellent garaging, quoted $3.5-3.7m, sold for $3.93m

- 15a Osborne Court Hawthorn – neat, extended 1930s home near the river, quoted $2-2.2m, sold before auction for $2.511m

Some of the better properties currently on the market; an architect’s view

15 Mills Street Hampton – Jenny Dwyer/Sandra Michael, Belle Property

34 Glendearg Grove Malvern – John Manton/Fiona Ansell-Jones, Marshall White

55 Guildford Road Surrey Hills – David Smith/Nikki van Gulick, Marshall White

‘Off-market’ Properties:

- Double fronted, timber, Victorian, 4-2-2, Elwood – circa early $3m

- Renovate or rebuild, 4-2-3, ~920sqm, Brighton East – circa $3.9m

- Freestanding TH in heart of Village, 3-1.5-1, Sandringham – circa $1.5m

- Modern family home, 4-3-2, ~940sqm, Brighton – circa $5.5m

- Double fronted, brick, Victorian, 4-2-1, Brighton – circa $3.7m

- Brick period home, 5-3-2, opp park, Hampton – circa $2.6m

- Edwardian, 4-2-2, ~680sqm, north rear, Cheltenham – circa $1.9m

- Downsizer, 3-2.5-2, renovated, Malvern – circa $3m

- Double fronted Victorian, 4-2.5-1, renovated, Brunswick – circa $2.15m

- Fully renovated/extended brick single front, 3-3-2, West Melbourne – circa $3.7m

- Fully renovated, contemporary, 5-3-2, 3 living, pool, Glen Iris – circa $3.4m

- Modern family home, 4-3-2, ~700sqm, spa, Kew – circa $3m

- Renovated brick Edwardian single fronter, 3-1, Prahran – circa $2.1m

How long are you prepared to place your life on hold?

We are almost six weeks into 2023 and the property market is getting its buzz back.

We think the market will remain buoyant until Easter, for the following reasons:

- Stock levels have increased significantly over the past fortnight and there are some good properties out there for buyers to consider.

- Buyer numbers have been very good at open for inspections (sometimes double or triple what we were seeing at the end of last year).

- More importantly, how long is everyone prepared to place their lives on hold waiting for the market to go up or down, waiting for interest rates to go up and down, waiting for property prices to plummet, waiting for mortgagee sales?

- The rental market is as hot as it has been for a very long time. Buying for many is a better option even if interest rates are on the rise, as investors are coming back in as the numbers are making this a more viable financial option for them.

It’s been three years of indecision and uncertainty. But life is starting to feel ‘normal’ again.

Singles are coupling, downsizers are aging and families are growing.

For a while now, the locals have had the market ‘to themselves’, but with migration levels on the rise again (in part due to the Chinese Government’s recent snap decision to only acknowledge international degrees if classes are taken in person) this will change, we think.

If the goal is to buy a good property that meets your requirements for the mid-to-longer term, we don’t recall any homeowners (who have done so, in varying markets) wishing they had waited a few years before deciding to make the move.

If it’s the right house, it’s the right time.

To work out if it’s the right house, homework, research and sound due diligence is the key:

- Know your budget

- Know your non-negotiables

- Know your suburb

- Know how to negotiate – and understand that most selling agents are very good at what they do and have many industry resources and analytics at their disposal

- Know your prices

- Know how to protect yourself or keep yourself in the game

- Know when to stop

Research, research, research. We have been doing it for more than a combined 35 years and we have experienced the ups and downs associated with the rollercoaster of the property market.

If the right property is there, now is as good a time as ever to buy.

We believe prices at the moment are fair for both parties. Generally, they’re not going up (unless it’s one out of the box and ticking multiple criteria for a variety of buyers) but they’re not plummeting either.

We are hearing that many buyers are waiting for prices to continue to fall – but in reality will this happen?

The same property could sell four times within a year and get a different result every time.

Having said that, there will still be some properties that don’t sell easily. More often than not, they may come with complications such as high prices, tricky overlays, awkward renovations (completed or needing to be done), positions on the block or compromised orientations, to name a few.

Some of these problems can be overcome with price, others are better avoided altogether. Know how to recognise them and how to avoid them – that is not as easy as it seems.

With limited auctions around on the weekend, early results for some good properties were as expected:

- 58a Sandringham Road Sandringham – single storey, immediately livable, self-sufficient (solar panels and battery) rear townhouse, walking distance to the Village and station, quoted $1.5-1.6m, sold with three bidders for $1,700,500.

- 9 Derby Street Camberwell – dated two storey mock period home on 624sqm – quoted $2.9—$3.19m sold for $3,570,000.

Also some notable larger sales transacting this year:

- 7 Sorrett Avenue Malvern – solid family home in prime street, good land, north rear – sold privately just over $6.85m

- 21 Montalto Avenue Toorak – quintessential Toorak offering on over 900sqm land – sold privately for over $8.9m

No doubt the media will hone in on the negatives – it’s bound to sell more papers! Making decisions based on their often limited research may not be the right thing to do for you.

Some of the better properties currently on the market; an architect’s view

34 Thanet Street Malvern – Ansell-Jones/Manton, Marshall White

26 Walerna Road Glen Iris – Wood/Pessin, Jellis Craig

‘Off-market’ Properties:

- Modern family home, 4 bed, 3.5 bath, DLUG, pool, corner position, Brighton – circa $5.5m

- Modern 3 bed plus study, basement garage, lift, pool, Brighton – circa high $5m

- Land for dream home, west rear, approx. 670sqm, near schools, Hampton – circa $2.7m

- Californian Bungalow, 4 bed, 2 bath, 2 OSP, Sandringham – circa $2.25m

- Period weatherboard, walk to shops/station, ~400sqm, Hampton – circa $2m

- Contemporary 4 bed, 2 bath, DLUG family home, ~950sqm, Black Rock – circa $3.2m

- 5 bed, 5 bath family home near beach & Church Street, Brighton – circa $6.5m+

- Modern family home, master up, adjoining park, pool, Hampton – circa $4.25m

- 2 storey townhouse, 3-2-2, near amenities, NW courtyard, Brighton – circa $2.1m

- Fully renovated brick Edwardian, 4 bed, 2.5 bath, ample OSP, ~680sqm, Elwood – circa $6m

- Fully renovated 4 bed, 3.5 bath, OSP, period home, pool, west rear, Malvern East – over $4m

- 2 storey 4 bed, 2 bath family home. Fully renovated with north facing private courtyard. $5.5-$5.8m

- 5+ bed, 3 baths, parking for 3 cars, approx. 910sqm, west rear, Malvern East – circa $3.75m

- 5+beds, 3 bath, two storey family home, approx. 1,270 sqm, Glen Iris – circa $6m

- Single level Victorian, 3 beds, 1 bath, SLUG, east rear, ~500sqm, South Yarra – circa $4.5m

- 3 bed, 2 bath and study townhouse over three levels, DLUG, Armadale – circa $2.75m

- 2 storey 4 bed, 2 bath family home, fully renovated, north courtyard, South Yarra – circa $5.7m

- Brick Edwardian, 2 bed, 1 bath, 1 car, ~280sqm, Malvern – circa $1.6m

- Double fronted Edwardian, 4 bed, 2 bath, 2 car, pool, ~530sqm, Armadale – circa $4m

- Single fronted Edwardian, 3 bed, 2 bath, no car, ~120sqm, South Yarra – circa $2.1m

- Townhouse, 4 bed, 4 bath, 3 cars, ~500sqm, Armadale – circa $4.1m

- Unrenovated Edwardian, 4 bed, 2 bath, 2 cars, ~1,320sqm, Hawthorn – circa $4.4m

Auction Spotlight:

A good crowd turned out to watch and bid at the auction of this updated single level rear villa. Prepped for sustainability, the home includes a solar PV system with battery storage, as well as an EV charger and heat pump hot water. Well positioned to the village and trains, the offering was always going to be appealing to downsizers. The home had been quoted $1.5-1.6m throughout the campaign. Mark Earle led the auction for the Buxton team, placing a vendor bid of $1.5m to get things started. One bidder countered but was immediately trying to slow things down. A further two bidders were more proactive, steadily lifting the price before the home was announced on the market at $1.685m. The home was eventually sold for $1,700,500. A fair price for the home on offer.

2022 – a year like no other

2022 was a whirlwind year: it seemed like three years of life crammed into one. As a society, we resumed doing things as we had in the past, like travel, holidays away and community sport.

It was a year of firsts in many circumstances, as everyone tried to navigate their way out of the two-year lockdown.

Some experiences were positive and uplifting. Others provided some insights into the minds of many affected by our prolonged lockdowns. Flexibility and creativity were required to ensure a good outcome for all when it came to buying properties as we navigated the changing market. Traditional Saturday auctions were not as common as they had been in years before, and agents have developed new skills to better serve their vendors.

We felt the overall sentiment from buyers and sellers for the final quarter of 2022 picked up, when comparing the market to earlier in the year. It seems many buyers had put their searches on hold waiting for the significant drop in property prices that the media kept promising, which never really happened for the better properties.

As the end of year started to close in, we noticed a number of buyers come to the realisation that if they didn’t action their plans now, they would be starting 2023 in the same predicament as 2022 … with no home.

Although interest rates and building costs were rising, stock levels were shrinking and the two together didn’t equal total doom and gloom.

We are not arguing that the market hasn’t changed. It has. Interest rates have increased, with eight consecutive rises. Buyers cannot access money the same way they could 12 months ago. Building costs have increased. Tradespeople are harder to get. Many buyers and sellers have withdrawn from the market. Some properties have dropped in value. Overall sentiment has changed. But not everything has gone down.

More repeatable properties, such as apartments or townhouses (where townhouses are in abundance) have seen reductions in larger numbers. Quality family homes or properties that are not as easily repeatable have still been in demand.

It can be hard to determine changes up and down, as there are so many variables and rarely are the same properties up for sale again in quick succession to compare results.

When sentiment changes, many vendors choose not to sell, which means there are less homes for sale and, often, less of the better homes. Vendors can also have over-inflated expectations that weren’t realistic in the first place, so when they sell for less than their original asking price, it is assumed that the property is selling for less than it is worth; however, it may never have been worth the asking price in the first place.

We have taken this opportunity to reflect on some homes that have sold this year that have had two or more sales within quick succession of each other, and a high majority have sold for more than the previous sale price, also contrary to what the media has been telling people all year.

The below list of sold properties have had no, or very limited, changes to the properties before being put back on the market again.

While a few made losses, the majority sold for more than they were purchased for no more than a couple of years earlier. Highlighting that not everything is doom and gloom and each property should be considered on a case-by-case basis.

39 Black Street Brighton

- November 2020, $3.85m

- January 2022, $4.355m

- October 2022, $4.45m

15 Raynes Park Road Hampton

- June 2020, $1.98m

- October 2022, $2.52m

11 Glenbrook Avenue Malvern East

- June 2021, $4.454m

- September 2022, $4.125m (drop)

79 Bay Road Sandringham

- December 2020, $2.7m

- July 2022, $3.15m*

10 Seymour Road Elsternwick

- March 2021, $2.72m

- August 2022, $2.74m

15 Vardon Avenue Beaumaris

- March 2021, $2.085m

- August 2022, $2.3225m

14 Edro Avenue Brighton East

- September 2021, $5.5m

- November 2022, $5.85m*

2/2 Trawalla Avenue Toorak

- January 2022, $3.4m

- August 2022, $3.05m (drop)

8 Johnson Street Hawthorn

- June 2021 $2.675m

- November 2022 $2.370m (drop)

*is approximate value

So where does that leave us for next year? Perhaps a little wiser and less inclined to rely exclusively on the media hype.

For buyers looking to make a quick profit, perhaps buying now isn’t the smartest move, unless you can hold if the profit isn’t there.

However, for buyers looking to invest in a good property that will suit them for the next 5, 10, 20 plus years, know what you want, do your due diligence, and make sure you have a good strategy in place to purchase, and now may be as good a time as any to take that step back into the market. Agents have developed more skills, and data analytics are certainly helping vendors. Buyer representation, we believe, will become increasingly important.

We are confident that the clients we purchased properties for this year will be very happy with their purchases and the prices they paid for a long time to come.

So for now, we wish everyone who celebrates Christmas, a wonderful day and a happy new year to all.

‘Off-market’ or ‘pre-market’ Properties:

- 4 bed family home, ~580sqm, green belt of Sandringham – circa $1.85m

- Contemporary 3 bed TH near amenities, Brighton – circa $2.1m

- Californian Bungalow, 4 bed, near schools/amenities, Hampton – circa $3.1m

- Contemporary home w basement, court, pool, ~2,000sqm, Brighton – circa $13.5m

- Modern side-by-side TH, 4-3-2, master down, Hampton – circa $2.3m

- Contemporary TH style home, 4-2-2, near shops, Hampton – circa $1.8m

- Renovated, 4-3-2, ~600sqm, school zone, McKinnon – circa $2.1m

- Victorian single fronter, 2-1-0, Elsternwick – circa $1.55m

- Period Family home, 3 bed, 2 bath, close to amenities, Armadale – circa $3.2m

- Single level brick home, 4-2-2, large living, pool, Malvern East – circa $2.5m

- Family home 4 bed, opp. to add value, Camberwell High school zone – circa $2.8m

- Free standing Edwardian, 3-2-2, 2 living, courtyard, Prahran – circa $1.6m

- Townhouse, 3-2-2, 2 living, courtyard, Armadale – circa $2.2m

- Single level Victorian, renovated, 4-3,3, walk to amenities, Armadale – circa $5.2m

- Renovated, Double Fronted, Art Deco, 4,3,3 with a pool & spa, Malvern East, circa $3.3m

Markets within the market

We believe Melbourne is continuing to run a two-tiered market at the moment: there are the properties buyers want to buy that are in limited supply and then the rest of the market.

A good quality, new or renovated family home or downsizer property, if priced and marketed correctly and managed by a good selling agent, currently has the capacity to achieve even higher results than it may have earlier in the year when there was more choice for buyers.

Good stock is very low. With the end of the year almost upon us, a number of buyers who have been patiently waiting for the market to crash (as per media hype) have started to realise that a whole year has gone by and not much has changed, including the fact that they still haven’t bought anything.

That’s not to say that all properties are performing well. Many of the homes that have sold at auction more recently have sold post-auction in private negotiations, often with only one interested purchaser. Buyers are wary of homes that are perceived as going to need money spent on them either straight away or sometime in the future.

Of the properties that haven’t sold at auction, there are no doubt a number of vendors who, in hindsight, wish they had accepted fair offers. We have noticed, particularly in the past week or two, as we get closer to the end of the year, agents coming back to us to see if our buyers are still interested in purchasing properties that they walked away from during negotiations. Many of these buyers have now shifted their focus to other properties or purchased something else.

There are some vendors who have had no, or limited, interest from buyers. This may be a result of the product, the price, the marketing strategy, the media or a combination of all of these factors.

With all the uncertainty going around, buyers are not sure what they should even be doing. They don’t want to be seen to be paying too much, or offering too soon, or even bidding at auction which can seriously affect their outcome when trying to buy a property they like.

What we do know for certain is that you cannot rely on a blanket description for what is happening the Melbourne market at the moment, as there are many mini markets within the overall property market and strategies to purchase will vary significantly depending on what you are trying to purchase.

Some of the limited good homes (both in Melbourne and holiday regions) that have sold well include:

- 8 Maling Road Canterbury – renovated family home, quoted $4-4.4m, $4,930,000

- 43 Barrington Avenue Kew – renovated family home, quoted $4.4-4.9m, undisclosed over $5.5m

- 1 Nyora Street Malvern East – very liveable, approx. 20yo single storey home, smaller land, could also update (suit downsizers), $3m

- 3 Tollington Avenue Malvern East – updated, single storey home, smaller land (suit downsizers), undisclosed over $3.5m

- 8 Hearn Street Dromana – as new family home with panoramic views, quoted $3.95-4.3m, undisclosed in excess of $4.5m

Some of the better properties currently on the market; an architect’s view

9 Coreen Avenue Beaumaris – Scott Hamilton/Stefan Delyster, Buxton

44a Shelley Street Elwood – Damian de Silva/James Meldrum, RT Edgar

93 Claremont Avenue Malvern – Oliver Booth/Nicky Rowe, Kay & Burton

2 Fairview Grove Glen Iris – Mark Wridgway/Yvette Laws, RT Edgar

13 Maitland Street, Glen Iris – Carla Fetter/David Sciola, Jellis Craig

‘Off-market’ Properties:

- Large family home, needing update, north rear ~780sqm, Brighton – circa $4.5m

- Bay views, 2 storey, looking for update, ~330sqm, Hampton – circa $2.3m

- Large family home on approx. 1,400sqm, Brighton – circa high $6m

- Contemporary family home, looking for update, Brighton – circa mid $3m

- Family home, prime position, 4-2-2 with pool, Hampton – circa $3.4m

- Modern family home, master up, pool, Beaumaris – circa $3m

- Stately Victorian, 6 beds, north rear ~780sqm, St Kilda – circa high $4m

- Mid-century home, adjoining golf course, Cheltenham – circa $1.8m

- Townhouse, 4 bed, 3 bath, near Central Park/Hedgeley Dene Gardens, Malvern East – circa $2.5m

- Victorian family home, 5 beds, 4 baths, approx. 1,250 sqm, pool, Armadale – circa $10m

- Edwardian, two level 5 bed family home, approx. 711 sqm, Malvern – circa $5.5m

- Single Level Renovated Victorian, 4 beds, 3 baths, Malvern – circa $5.5m

- Renovated Victorian Italianate, 5 beds, 3 baths, study, pool, ~1185 sqm, Kew – circa $8-8.5m

- Double Storey neo-Georgian 5 bed, 4 bath over two levels, Kew – circa $4.1m

Finally, we would like to welcome Chris Guest to the WoledgeHatt team. Chris is a licensed real estate agent who has returned to property after working with Marshall White and RT Edgar for seven years in the early 2000s. Chris brings with him a passion for property and people and is looking forward to helping buyers achieve their property goals.

Auction Spotlights:

37 Cowper Street Sandringham

While the upstairs layout had some shortcomings, the downstairs flow to an entertainer’s deck, plus the fantastic beachside location, attracted many for auction day. The price quote of $1.65-1.75m was also appealing. Rod Richardson from Belle property headed up the auction and quickly received the first bid of $1.49m. Clearly below expectations, a vendor bid followed to push things along, before a second and third genuine bidder joined and things moved along at a steady pace. The home was called on the market at $1.755m. Both bidders clearly wanted the home – one a young couple, one a couple of empty nesters. Neither seemed keen to make a big jump though, and the auction crawled along with seemingly endless $1,000 or $2,000 bids. The younger couple eventually ran out of resources, leaving bidder 1 as the successful purchaser for $1.88m.

43 Barrington Avenue Kew

Auctioneer Scott Pattinson from Kay & Burton conducted a private auction for this fine renovated period home in Kew. With around 6 registered bidders, it didn’t take too long to get a result here with the property selling well in excess of the top of the quoted range.

Will the market change for Q4 2022?

Will the market change for the final quarter of 2022? Most property platforms (media and databases) have taken to using emotive and sensational phrases to sell their papers and the reports don’t always provide a true reflection of what is happening out there.

There are definitely a number of factors that could support a further drop:

- Increasing interest rates

- Reduced access to finance

- Increasing stock numbers (expected, but may not eventuate)

- November election looming

- Fixed rate vendors needing to sell as their fixed term ends

- Cost (dollars and trade availability) of renovating

- Indecision generally

However, there are also some factors that could result in the market staying the same, which we see as a more normal market, rather than a ‘down and out market’ that the media are pushing:

- Less stock (compared to previous years)

- Less good quality stock

- Opportunity (less competition)

- Buyers preferring to buy to upgrade rather than renovate

- A number of cashed-up buyers who believe now is a good time to buy

- Buyers who have been waiting a long time to buy and are becoming increasingly impatient

- Families looking to establish themselves in homes for the 2023 school year

In a slowing market, we tend to find that the volume of good properties reduces and unless a vendor needs to sell (already purchased, divorce, death, relocation etc), there is a preference for vendors to hold onto their homes.

As a result, fewer quality properties are available to purchase and the gap between the A graders and C graders grows. The current market is one where, if you have purchased a C grader in a flying market and need to sell, you may find yourself having to accept less than you paid for it (depending on when you purchased it).

Many buyers think that buying anything is better than buying nothing when the market is racing; however, if you purchase something that doesn’t work or has some fundamental issues, it can really hurt financially as well as add to the already stressful decisions associated with selling a property, if you need to sell it down the track (particularly if it wasn’t purchased that long ago).

We believe stock levels will play a big part in determining where 2022 finishes up at the end of the year. At the moment, stock is still considered low and the good stock, quality downsizers and family homes (ready to move into), is even lower.

At the inspections for a downsizer property at 1 Nyora Street Malvern East (a well located, single storey home, in original condition but a quality build with good proportions) the queues were reminiscent of the post-lockdown opens, all waiting for the agent to arrive.

Originally quoted under $2 million, the response was overwhelming and the auction was brought forward, selling for an undisclosed amount around $3 million, supporting our belief that if it’s good, there is still solid demand and currently no shortage of buyers willing to step forward.

Some other quality properties that have sold well more recently include:

- 12 Hawthorn Grove Hawthorn, pretty period home with good front rooms on large land, ready for a new rear update, sold for $7,920,000.

- 19 The Avenue Hampton, sold for an undisclosed amount in the higher $5 millions.

- 59 Union Street Armadale, renovated period home on 800sqm, sold for $7,950,000.

- 281 Richardson Street Middle Park, double fronted period home on 371sqm, great street, ready for the next renovation, sold for $5,050,000.

- 14 Christowel Street Camberwell, renovated period home on 1180sqm, sold for $6,700,000.

- 17 Kerferd Street Malvern East, family home on 920sqm, modern style home in a predominant heritage precinct, sold for $5,370,000.

The above properties represent what we think are good properties. There are many more we could list that have compromises, require significant work or have been priced incorrectly, that have struggled to sell and are still for sale. Will these sell before the end of the year? Only time will tell.

We do feel there are quite a lot of off market properties around at present and this can be a good way for a seller to achieve a result without risking a failed campaign.

With around 80 days until Christmas and the Melbourne Cup weekend not too far away, there may not be too many properties advertised publicly in the next couple of weeks. If the market is to pick up this year in terms of volume, sellers may back themselves in for a late sprint to get in before the summer break. Or they might just decide to wait until early 2023. As always, it will depend on the motivations of the vendor.

Some of the better properties currently on the market; an architect’s view

64 Hawthorn Grove Hawthorn – James Tostevin/Désirée Wakim, Marshall White

53 South Road Brighton – Simone Chin/Suzie Farrell, Atria Real Estate

28 Kerferd Street Malvern East – Matthew Morley/Jeremy Rosens, Gary Peer

‘Off-market’ & ‘Pre-market’ Properties:

- Contemporary 4 bed home, east rear, Toorak – circa $5.25m

- Renovated Californian Bungalow, single level, Malvern – circa $3.5m

- Double storey 1920s home, renovated, near Central Park, Malvern East – early $5m

- Neo-Georgian 2 storey family home, Kew – circa $4m

- Tudor style home on approx. 870sqm, Camberwell – circa $3m

- Renovated Victorian, ~800sqm, Camberwell – circa $6m

- Federation family home, ~890sqm, Camberwell – circa $6m

- Basic Cal Bung/land, east rear, approx. 1100sqm, Kew – circa $5.8m

- Single level Edwardian near amenities, Brighton – circa $3m+

- Extended art deco family home, central Brighton – circa high $4m

- 2 storey Californian Bungalow, ~630sqm west rear, Hampton – circa early $3m

- Modern 2 storey executive style home, Brighton – circa high $3m

- New home site near amenities, NW rear, ~650sqm, Brighton – circa high $4m

- Victorian family home, ~900sqm, good position & car access, St Kilda East – circa $4m

Numbers still good, but only at the good properties

Media hype not telling full story

No shortage of interested parties for the first open at 14 Christowel Street Camberwell – a well renovated period home.

Most buyers, sellers and agents have now returned from their mid-year hiatus and, for many, a much-needed break after two very tough years.

Despite the media’s best attempts to portray doom and gloom, using the most negative adjectives and emotive language available to sell their story, the market is still transacting.

And for the better properties, we don’t believe there has been a fall in price at all.

That is not to say that there have been no changes in interest levels, prices, quotes and volume and it is also not to say that we won’t see a continuing downward drop in old prices moving forward.

The sharp rise in interest rates, with future projected rises, will no doubt have an impact on some families’ budgets, which could result in more homes hitting the market as vendors try to sell quickly before the market drops further, possibly tipping the number of buyers versus sellers out of kilter and in favour of the buyer as stock numbers rise.

It will, however, depend on the type of stock available.

We are aware of a number of properties quietly for sale requiring major renovation or new builds, where vendors, whilst they may have the capacity to continue, no longer have the desire or want to take the time to undertake the works. Renovators are, more than ever, morphing into buyers.

We have also noted more resistance from buyers toward properties that need additional money spent on them, preferring the security of purchasing a property where the price is quantified and there is more certainty around budgeting for future repayments.

For vendors who have these homes, unless they need to sell, many are opting to hold their plans until the sentiment improves.

We have noticed a great mix to quote prices. Interestingly, some vendors still think they might be able to sell for a price (including stamp duty) well above what they paid for the property only a year or two earlier.

For example, 15 Vardon Avenue Beaumaris, which went to auction on Saturday (with only some minor improvements after selling for $2.085m 15 months ago), passed in on a genuine bid of $2.285m, exactly $200,000 over. The home had been quoted $2.285-2.385m and sold later around the middle of the quote range.

Another currently for sale in Malvern East sold around a year ago circa $4.5m is now asking $5m (off market). This is only one example of many similar properties currently for sale.

Expression of interest campaigns are also increasing. Why? It helps protect a vendor’s asking price (especially if it is above market expectations) and it also provides some smoke and mirrors around ‘other interest’ when managing buyers interested in purchasing the property, unlike an auction that can make it very obvious how much interest (or lack of interest) there is.

The ‘buy before sell’/‘sell before buy’ switch has also changed. Many property owners are preferring to sell first now, mitigating the risk of not being able to sell at an expected price. This will hopefully open up stock levels, however we are not really seeing that yet.

We feel if the property is handled by an experienced agent (who has worked in many different markets and understands their area) and is quoted correctly, excellent results are still being achieved for the seller.

So where to from here? If you have confidence in your job security and borrowing capacity, it can be a good time to buy. Making sure you are buying the right home is still most important, keeping in mind some properties haven’t dropped much (if anything), depending on what you are buying while also ensuring you don’t overpay in the current market either, should you need to sell again unplanned in the short term.

The mantra we often use to our clients: buying as well as you can for your money, and the ability to make good informed decisions, still holds true today. For if the purchase decision is not right, (ie a home that seems a ‘bargain’ price on the day of purchase, regardless of suitability or whether the property is in fact in any good) then this could be very costly not only financially if you have to sell it, but emotionally if you are not happy living there.

Some of the better properties currently on the market; an architect’s view

11 Fraser Street Malvern – Tim Bennison/Will Bennison, Jellis Craig

14 Christowel Street Camberwell – Scott Patterson/Walter Dodich, Kay & Burton

344 Beach Road Black Rock – Oliver Bruce/Matthew Pillios, Marshall White

‘Off-market’ / Pre-market Properties:

- Fully renovated & extended single fronter, 3-2-1, Prahran – circa $2.5m

- Large Edwardian family home on ~730sqm, Malvern East – circa $5.75m

- Contemporary family home on over 100sqm, Malvern East – circa $5m

- Modern large family home w pool and basement, Malvern East – circa $5.3m

- Updated Art Deco home, 3-2-2, ~600sqm, Ashburton – circa $2.1m

- Fully renovated & extended family sized Victorian, Camberwell, circa $5m

- Renovated single level Edwardian, 4-2-2, Camberwell – circa $4.2m

- Single fronter, 2-1, opp. Top add value, Hawthorn – circa $1.6m

- Two storey Californian Bungalow, Castlefield Estate, Hampton – circa $3.3m

- New family size townhouse, 5-4-2 on ~350sqm, Brighton – circa $3.6m

- Family home, St Kilda – circa $4.5m

- Modern home with pool, Caulfield North – circa $4.5m

Winter in Melbourne: is it a good time to buy or sell?

There is no doubt the market has changed since the start of the year. Expectations, sentiment and confidence is lower and the general results support this.

Some vendors have been lucky enough over the weekend to have the opportunity to decide whether to sell or not (i.e. had bidding from two or more parties but still passed in); others have had to watch their homes pass in with no bids at all.

As an example, a couple that passed-in, in Bayside this weekend, had multiple bidders. This indicates there is now a growing gap between buyer and vendor expectations, rather than no buyers around to purchase.

- 15 Bright Street Brighton East, quoting $1.8m passed in for $1.88m with two genuine bidders.

- 133 Linacre Road Hampton, quoting $2.3-2.4m passed in for $2.315m with three bidders.

The key question for now, for both buyers and sellers alike, is should you buy/sell or should you wait?

For some, that answer may be yes.

For others, no.

Why?

Goals, needs, circumstances, and time to name a few. Families continue to grow.

There are some big reasons why one could argue that now is not the time to buy and the media is helping to fuel the negativity by providing daily reports on:

- rising interest rates

- rising building costs

- rising costs of living

- falling stocks

- dropping house prices

- the war in Ukraine

- talk of US recession.

These topics all sell newspapers, which seems to have become the main goal of the news providers.

There are other reasons for low stock also:

- Winter is traditionally a slow selling season, given the cold weather and the fact that properties don’t present in their best light (particularly gardens).

- Many families (and agents) are taking overseas holidays for the first time in many years.

So what reasons could encourage buyers to buy now?

- Less competition

- Timing – can’t afford to wait

- Potential opportunities – particularly for the properties that require work

- Low unemployment/job security

- Relative safety of investment

- Long term purchase plans.

And why would vendors consider selling now?

- Prices may be better now than in 3, 6, 12 months’ time

- They have already purchased something and need to sell

- They are needing to upsize/downsize irrespective of the market

- They are relocating for work/lifestyle.

Transactions have shifted, partially due to the start of the holiday season and partially because vendors are more reluctant to shell out large amounts of money for advertising and staging, to ‘not’ get a result, and the ‘off market’/private sale market is back.

For vendors considering selling, it is even more important to engage experienced agents who have the knowledge and skill to sell homes outside the ‘auction’ method that works so well in a strong, rising market.

For buyers, stock levels are likely to tighten further, particularly if vendors don’t have to sell.

And that is the key. If the vendor does not have to sell, they simply will hold on to the property. Simple.

There are a number of buyers who have entered the market – and these are those who are planning on renovating. This process is becoming more cost prohibitive and lengthy to undertake, so why not take that renovation budget and put it into something already completed?

We’ve noticed a number of agents/agencies starting to push the benefits of ‘off the plan’ sales. While this may seem an attractive option when stock levels are so low, buyers should ensure the full due diligence is undertaken so there are no surprises when handover/settlement takes place, sometimes two or three years down the track.

And yes, it can take that long. Before building can commence, developers often have to sell a percentage of the development before funding is approved, find a builder, hope the builder can start straight away, hope the builder doesn’t go under, hope that the development finishes on time … the list goes on.

We still recall one conveyancer’s comments that over 80% of the clients their office had, who purchased off the plan, were ‘disappointed’! That’s a high number of disappointed buyers. Whether they are disappointed because of size, ceiling heights, lack of light, quality of finish, number of faults to be rectified, overlooking, timing, smells, noise, neighbours (the list goes on …), it’s a whole lot of disappointment that is worth a good deal of consideration before signing any contracts, that promise a low up-front (sometimes refundable) deposit and no stamp duty.

For those who prefer to be able to see, touch and feel what they’re buying, in summary, there are some good opportunities around, however, stock is going to remain low over Winter.

In the meantime, enjoy making the most of the holiday season and the opportunity to get away after two years of lockdown. We anticipate a pretty solid spring selling season, and for the foreseeable future it appears that demand will outweigh supply. But as a vendor you need to have realistic expectations and the appointment of an experienced selling agent

(who has a solid track record of selling in the area) is, we think, so important.

Some of the better properties currently on the market; an architect’s view

60 Berkeley Street Hawthorn – Peter Vigano/Jessica Zhang, Jellis Craig

27 Moffat Street Brighton – Matthew Pillios/Kate Strickland, Marshall White

‘Off-market’ Properties:

- Rear home with city views, 4-3-2, Hawthorn – circa $1.75m

- 80s single level home/new home site, ~830sqm, Canterbury – early $3m

- Vacant land to build, ~860sqm, east rear, Kew – circa $4m

- Renovated art deco semi, 2-1-3, Glen Iris – circa $1.35m

- Townhouse, 3-2-1, north-west garden, South Yarra – circa $1.45m

- Townhouse style home, 3-2.5-2, part updated, Armadale – circa $2.4m

- Timber 4 bed Edwardian, ~690sqm, Glen Iris – circa $3.6m

- Double fronted Victorian, 3-1-2, ~360sqm, St Kilda – circa $1.9m

- Basic single level/new home site, ~770sqm, Brighton East – circa $2.7m

- Hawthorne brick Victorian, central location, ~830sqm, Brighton – circa $5m

- Modern, Golden Mile, family home, 5-3-2, Brighton – high $4m

- Renovated period semi, 3 bed, ~360sqm, Balaclava – circa $1.8m

Auction Spotlight:

The family sized townhouse at 133 Linacre Road Hampton attracted quite a crowd for the morning sunshine auction. A newly built Hamptons style home with a functional floorpan for a two child family. The smaller outside space is compensated for by a number of parks within a short stroll. A little further away is the main shopping strip of Hampton Street. The home had been quoted at $2.3-2.4m most recently, after starting the campaign at a lower level. That lower level was likely where buyers were more comfortable, while the vendors were seeking to maximise their return on investment, plus the increase in building costs they encountered over the last year. Auctioneer Paul Bond represented the Hodges team, having to open proceedings with a $2.25m vendor bid. It was slow going to entice offers, eventually coming from three separate groups in smaller and smaller increments. At $2.315m the home was passed in for further negotiations with the highest bidder. The home sold after for $2.35m.