Market passes first real test of 2024

Four weeks into the Melbourne property market and there is definitely a pep in the step of both buyers and sellers. On the weekend just past, which was, we think, the first or second ‘real auction’ weekend of 2024 , the REIV recorded a clearance rate of 75% for the 746 auctions held, which is a healthy number. While buyers and sellers both have the confidence simultaneously to transact, it is still a mixed bag when it comes to results.

Key insights –

Large family homes in signature suburb streets are performing very well.

Land in Boroondara is popular (particularly land without restrictions or heritage overlays), with many buyers gaining confidence to again build new homes.

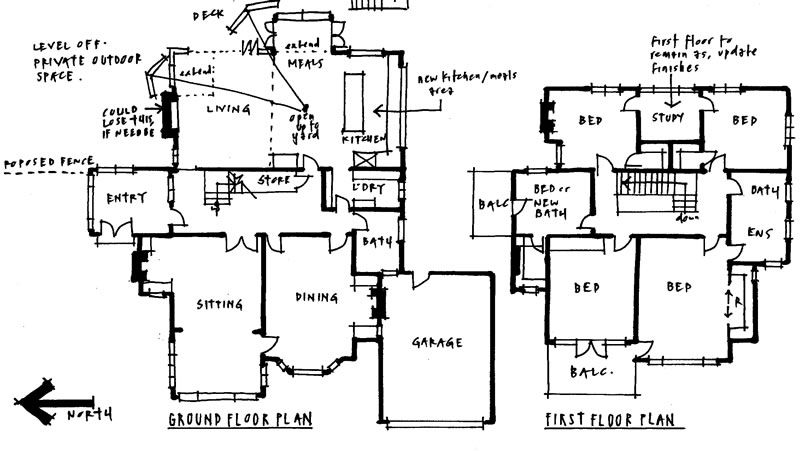

Generational period family homes with floor plans not suiting modern day living or requiring complicated renovations are losing favor with buyers.

The townhouse market is fickle, as buyers become more aware of build quality and the quality of spaces (i.e. outlook, light and space).

And:

The market is price sensitive.

In order to sell, vendors must get their price right, and it’s key that there’s a good understanding of what their property is and where it sits in the market. There are several components determining a vendor’s price.

Quote – the price set by agents to attract buyers to their home.

Reserve – the price they’re willing to sell for on auction day (most buyers expect this to be in the quote range).

Bottom price – the price willing/needing to sell if the home is still for sale in six month’s time.

Dream price – exactly that, vendors shouldn’t spend too much time thinking about it!

Buyers are becoming increasingly frustrated to see properties pass in (both within and above the quote range), with the vendors wanting a significantly higher price than the quote.

We understand, from a selling point of view, that the quote (along with photos) is one of the first things that attracts a buyer to a property and if it is quoted too high, they will not come through, making it very difficult to get a campaign back.

You may recall our comments around ‘listing’ in our December blog, where a number of agents appraised the same property with a variance of up to $1 million between the highest and lowest appraisal.

That property went to auction on the weekend and passed in on a vendor bid.

To keep things confidential, hypothetically let’s say the property was appraised for $2-3 million.

The agent who said they could get $3 million won the job.

They then advertised the property for sale for $2.4-2.6 million (well below the price they said they could get).

It passed in for $2.5 million on a vendor bid.

So, is the property worth $2m, $2.5m or $3m?

Were the vendors wrong to want to believe their house was worth more than the market? Maybe the agents really thought it was worth that much. The Statement of Information, however, wasn’t able to show any comparable homes. Of course, it hasn’t sold yet, so maybe they will still get it …

If the vendors are only willing to sell their home for their dream price, perhaps it is the agent who was dreaming or are they hoping that because the vendors have invested a lot of money and time to sell their home, that they will eventually come down to the market.

Either way, it leaves a lot of people (both buyers and sellers) frustrated and disheartened with the process.

On another note, we are seeing a number of downsizers struggling to find properties that may suit their needs after selling their larger family homes.

Downsizers want to believe the advice of their financial advisers, that they should sell their large family homes to move into a smaller home of lesser value, allowing them to reduce debt and/or put additional funds towards their retirement plans.

It sounds great and, for some, this works.

In reality, however, it can be a different story. Many buyers come to us after 20, 30 or more years in their family home, unaware that the home they have just sold may not even be enough money to buy something smaller and more suitable for their retirement.

It can be quite a shock to realise that they may no longer be able to live in the suburb they have always lived in, or that their only options are an apartment, villa unit or two storey town house (bedrooms upstairs!), often needing a cosmetic renovation, in their desired price range and location.

Downsizing the family home doesn’t necessarily mean downsizing your investment in the property market. It can actually sometimes require more money for the purchase than the amount the family home was sold for.

Downsizing is about reducing the often physical obligations that a larger property demands to ease the burden on vendors physically and emotionally, so they have less stress on their bodies and more time to do what they want to do after years of work.

It doesn’t mean that downsizers want to move into a ‘shoe box’. They still want family gatherings, often involving children and grandchildren, so they need more space than 70 to 100sqm apartments being built may offer, and that is why the downsize often isn’t downsizing financially.

There are options available for downsizers and we have helped many buy homes that work for both their current and future needs (and budget). But, before selling the family home, it is good to know what you may or may not be able to afford, as financial planning advice doesn’t always cover this.

The market will take a pause now for the Labour Day long weekend, then solid auction numbers come for the March 16 and 23 weekends How quickly the year goes – we are nearly at Easter!

Auction Highlights:

- 24 The Ridge Canterbury (Peter Vigano, Jellis Craig) quoted $6-6.6m sold $7.5m – land sale?

- 20 Madden Grove Kew (James Tostevin, Marshall White) quoted $3.0-3.3m sold for $4.0m – land sale?

- 9 The Crofts Richmond (Ed Hobbs, Biggin & Scott) quoted $3.2-3.5m sold for $3.64m

- 1 Chrystobel Crescent Hawthorn (Scott Patterson, Kay & Burton) quoted $7.0-7.5m sold in vicinity of $8.0m

- 7 Clyde Street Surrey Hills (David Banks, Jellis Craig) quoted $2.2-2.35m sold for $2.635m

- 17 Meek Street Brighton (John Clarkson, Buxton) quoted $5.0-5.5m sold for $5.6m

- 10 Cowper Street Sandringham (Mark Earle, Buxton) quoted $2.3-2.53m, then $2.5-2.6m sold for $3.005m

Some of the better properties currently on the market; an architect’s view

5 Southey Street Sandringham – Christa Hilaris/Fran Harkin, Belle Property

9 Rose Street Armadale – Gowan Stubbings/Jodie Cocker, Kay & Burton

33 Victoria Road Camberwell – Mike Beardsley/Richard James, Jellis Craig

‘Off-market’ Properties:

- Multi-generational home with sep. villa, 5-3-3, ~690sqm, pool, Beaumaris – circa $2.85m

- Large 80s home w. views, 5-3-3, ~720sqm, pool, Beaumaris – circa $3.4m

- Californian Bungalow, Castlefield Estate, 4-2-2, ~600sqm, Hampton – circa $2.6m

- Modern 2 storey, 4-3-2, ~440sqm, key position, Hampton – circa $3.75m

- Timber Edwardian, 4-2-2, ~760sqm, pool, North Brighton – circa $3.65m

- Edwardian 2 storey family home, 4-2-1, ~650sqm, pool, North Brighton – circa $4.25m

- Hamptons style family home, 4-3-2, pool, Sandringham – circa $4m

- Secure Townhouse, 4-3-2, North Brighton – circa $2.7m

- Contemporary family home, 5-3-3, ~650sqm, Brighton East – circa $3.7m

- New home site ~720sqm, 18m frontage, walk to beach, Beaumaris – circa $2.2m

- Edwardian family home, 4-2-0, ~390sqm, Elwood – circa $2.4m

- Renovated period single level, 4 bed, ~660sqm, Camberwell – circa $2.4m

- Family sized Townhouse, 4-3-2, master ground, Camberwell – circa $2.0m

- Modern large family home, 5-4-6, ~900sqm, Camberwell – circa $7.0m

- New home site, city views, ~640sqm, Kew – circa $3.4m

- 60s single level 3-1-2, ~640sqm angled block, Kew – circa $2.4m

- Fully renovated single level villa, 2-1-1, Glen Iris – circa $1.35m

- Californian Bungalow style, 5-4-4+, ~860sqm, pool, Malvern East – circa $5.4m

- Fully renovated single fronter, 3-2-0, ~300sqm, Armadale – circa $2.85m

- Period brick 2/3-1-1, looking for update, ~290sqm, Prahran – circa $1.5m

- Townhouse, 3-2-1, walk to amenities, South Yarra – circa $1.5m

- Victorian brick single fronter, 3-2-1, two storey, Fitzroy North – circa $2.4m

Auction Spotlight:

9 Hughes Street Malvern East

A crowd of about 30 gathered in the family friendly street to witness this auction.

On offer was an original Spanish Mission brick home, that had been renovated and extended back and up around 20 years ago – so a little dated, but with good fundamentals of bedroom separation, easy front-to-back flow and generous volume.

Auctioneer David Sciola gave a concise preamble and looked for bids in the lower part of the quoted range, and while none were forthcoming, announced a vendor bid of $2.85m. It didn’t take long for two bidders to take part in measured bidding, with the property passing in at $2.91m and eventually sold after for an undisclosed result just over $3.0m. Pretty good result for buyer and seller alike here.

41 Vincent Street Sandringham

The secluded front garden provided a relaxed location for the crowd of neighbours and prospective buyers at the auction of this well presented single level home. Set within the beautiful Vincent Street, the home appealed to a mix of downsizers, smaller families or professional couples looking to enjoy an indoor-outdoor lifestyle near the amenities of Sandringham. The home had been quoted $2.4-2.5m, before being lowered to $2.2-2.35m during the campaign. The higher starting point was likely where the vendors really wanted to see the sale, with post auction negotiations unable to seal the deal after being passed in for $2.25m on a genuine bid. The home remains for sale at time of publishing, at the second SOI range.