Volatile and uncertain: the Melbourne property market in 2023

With only two weeks left until Christmas, there are two types of buyers in the market at the moment:

- the buyers who have moved away from searching and packed up for the year in readiness for the market return after Australia Day in 2024; and

- the buyers who are determined to be new home owners before the year is out, some with plans for two or three auctions in a day, with little or no thought about how or why they should buy it.

Next year sounds like it is going to start positively. Agents are suggesting the volume will be better and the media (at this stage) is confident prices will continue to rise.

Since the media has started spruiking that property prices will rise in 2024, however, it seems a number of vendors have become overly excited about how much their property is really worth.

We could argue that some of the hype is also being driven by excited agents, trying to win listings. Agents are very good at saying the words vendors want to hear, and vendors are very good at focusing on the highest price mentioned, rather than where their property really sits in the market.

We are hearing of properties being appraised for sale with discrepancies anywhere from $500,000 to $1 million in the suggested value – and we are not talking $10 million properties; these are homes that sit around the $2-4 million mark.

At $2 million, these appraisal variances, of up to $1 million difference, are fuelling many vendors’ unrealistic expectations.

With vendors committing a lot of money up front to sell their homes (eg advertising, staging costs etc), they can find themselves anywhere from $10-50,000 out of pocket and still without a sale if they are only focusing on their home selling for the highest appraisal price.

As a side issue, costs also have risen with advertising – to the tune of around 10% we believe – all due to ‘rising costs’ the portals are purporting.

It’s not just vendors who get caught up with the suggested sale price by agents.

Many purchasers, in the hands of a skilled sales agent, can pay hundreds of thousands of dollars above the advertised price to secure a property, without realising that they’ve paid much more than the market may have dictated had the property gone to auction. This was particularly so during the pandemic where the fear of missing out was at its peak.

We are seeing this firsthand (as we are purchasing some of the good ones), where some of the homes bought in 2020 and 2021 are re-selling now for less than they were purchased for (and this is excluding stamp duty and other associated purchase costs, so the losses can add up quite quickly for vendors who had not considered the implications of their purchasing decisions not working out).

This isn’t a carte blanche rule, however, as there are also a number of homes purchased in 2020 and 2021 that have sold for similar amounts and sometimes quite a bit more than they were purchased for. Certainly, if they were bought well, and/or good properties, this is the case.

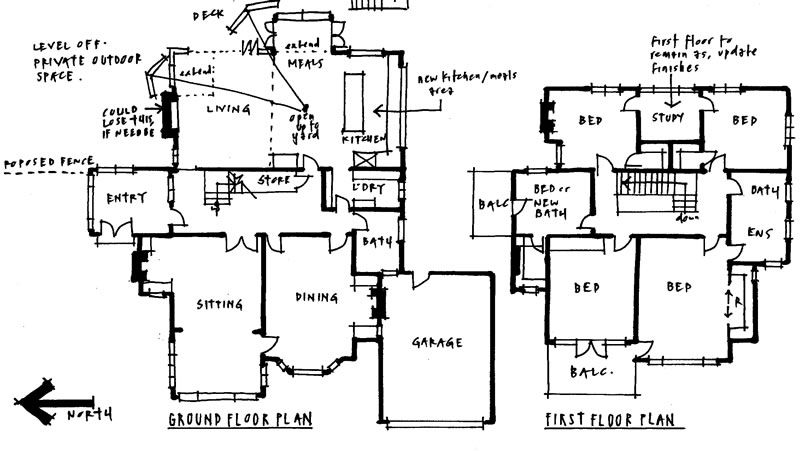

We are seeing a few more partially renovated homes for sale.

The increased rate rises, combined with building costs and/or builder insolvencies, has also resulted in a few unfinished/semi-renovated homes starting to come onto the market.

While this can be an opportunity for buyers, we feel some compassion and empathy toward the vendors who find themselves in this situation.

We have also noticed a number of properties passing in, either within the range or with no bids. The properties are often selling after auction for considerably more than their quote.

Alternatively, they are then advertised for private sale with an asking price much higher than their original quote range. For example, quote for auction campaign $1.8-1.98 million, but post-auction private sale asking price $2.2 million.

We are aware of companies also being fined by Consumer Affairs because the comparable sales for the property are wrong/irrelevant on the SOI. Many agents also often have none. Interestingly, we don’t seem to have the same difficulties when pricing properties for our clients.

As we wrap up our Market Pulse for the last time this year, we note some of the difficulties for all participants in the market and hope for a less tumultuous year in 2024.

- Multiple rate rises in succession (last seen in the late ’80s)

- Builder and building company insolvencies

- Increased cost for building supplies

- Media sensationalism at its best

- Lack of stock leading to more lack of stock (affecting supply of family homes in particular as downsizers can’t find their next option)

- Reduced borrowing capacity while market prices remained fairly steady or in some instances rose

- Large migrant intake

- Expats/migrants with greater buying capacity as a result of the low Australian dollar

- Property tax increases

- Rental increases

- Fewer rental properties available (as a result of them being sold)

For buyers, this has added greater complexity to a property market that is already heavily weighted in the vendor’s favour.

If this year hasn’t resulted in the purchase success you were hoping for, consider engaging the services of a buyer advocate in the new year. We are independent and work exclusively for you, the buyer.

Thank you for reading and following us this year. Our offices will be closed from Tuesday 19 December 2023, re-opening on Tuesday 16 January 2024. Merry Christmas and we wish you all a happy and safe holiday with your family and friends.

Some of the better properties currently on the market; an architect’s view

11 Curral Road Elsternwick – Angelos Stefanis/Bill Stavrakis, Biggin & Scott

28 Derby Street Camberwell – Chris Barrett/Hamish Tostevin, Marshall White

‘Off-market’/Pre-market Properties:

- Californian Bungalow, Castlefield Estate, 4-2-2, pool, Hampton – circa $3m

- Family sized Victorian, 5-4-3, pool, ~1,260sqm, Brighton – circa $6.4m

- Modern family home, 5-4-4, pool, Brighton – circa $5.75m

- Edwardian single level, 5-2-2, pool, ~780sqm, Brighton – circa $3.7m

- New home site near park/golf course, ~650sqm, Brighton East – circa $2.4m

- Contemporary 3-2-2, pool, full bay views, Black Rock – circa $2.8m

- Period single fronter, reno or rebuild (stca), Hampton – circa $1.65m

- Contemporary 4 bed near beach, ~750sqm, Hampton – circa 3.7m

- Californian Bungalow, needing update, 3-1-3, ~980sqm, Hampton – circa $3.5m

- 1920’s Edwardian home, 3-1-2, ~718sqm, Malvern East – circa $2.6m

- Three level Townhouse, 3-2-2, Armadale – circa $1.7m

- Family home, 4-3-2, pool, ~683sqm, Balwyn North – circa $3.4m

- 1930’s family home, 3-2-2, ~590sqm, Malvern East – circa $2.2m

- C1995 single level home, 3-2-3, west rear, Glen Iris – circa $1.3m

- Californian Bungalow, 4-2-5, ~734 sqm, Canterbury – circa $3.3m

- Victorian timber cottage, unrenovated, 2-1-0, ~211sqm, Hawthorn – circa $1.6m

- Edwardian family home, 3-2-1, ~394sqm, Malvern – circa $2.3m

- Single level home, 3-2-2, ~200sqm, Toorak – circa $2.2m

Auction Spotlight:

9 Monaco Crescent Beaumaris offered a solid family package; good volume, large than average land, pool, north rear plus the bonus of backing onto Royal Melbourne Golf Course. The home itself has been renovated in parts to be overall totally comfortable, yet with scope to update the remaining parts when desired. Clearly the offering had attracted plentiful interest. Starting the campaign with a quote of $2.3-2.4m, at least one early (unaccepted) offer pushed the pre-auction quote to $2.47m. Proceeding through to auction certainly reaped rewards for the vendors. The property quickly pushed past reserve at $2.48m and 6 active bidders fought it out to settle on the eventual selling price of $2.825m.

92A Sutherland Road Armadale

On a wet, rainy summer Melbourne morning, 50 people, most with umbrellas, attended the Auction in one of Armadale’s best streets, close to transport, cafes and shops.\

The Auctioneer got started with a vendor bid of $2m and it was not long after that some crowd participation started. Before we knew it 4 bidders were contesting for a good solid family home. The bidding quickly rose to $2.130m where it was announced “on the market” and they were playing for keeps. Eventually the property was sold for a strong price of $2.420m.