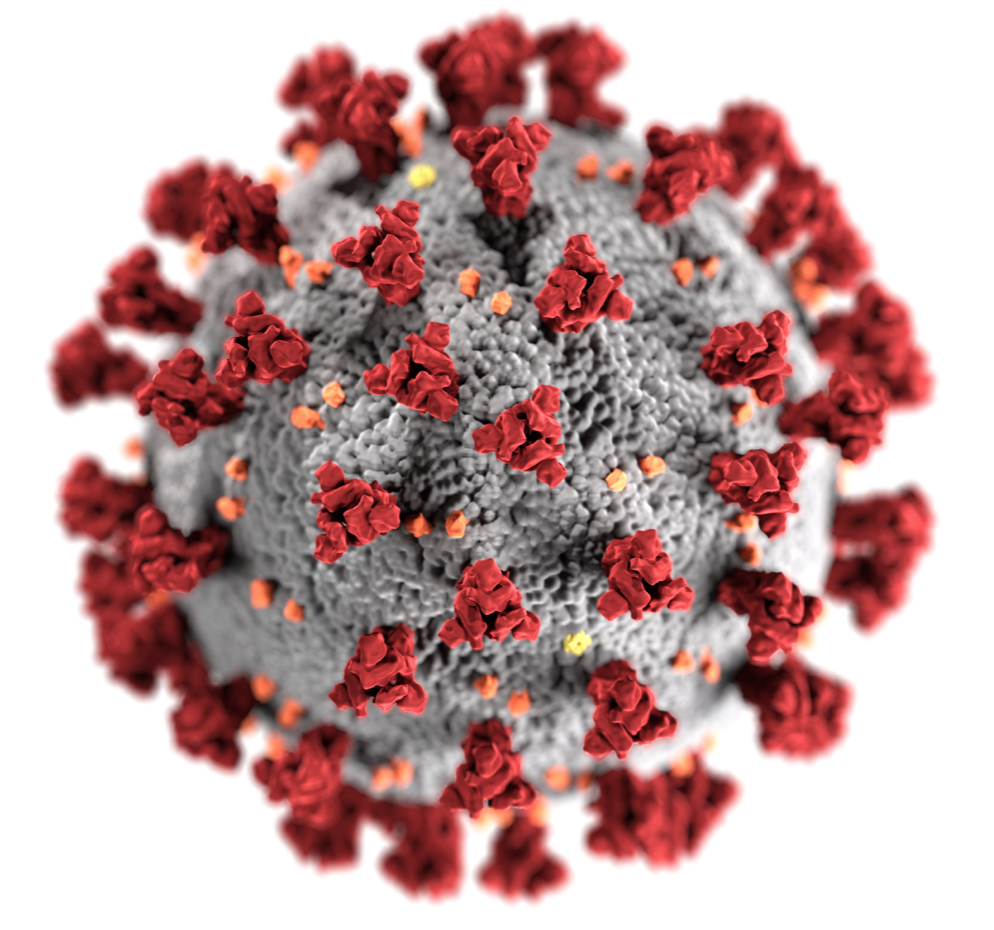

How has COVID-19 changed the Melbourne property market?

Online auctions – a new way of selling during COVID-19 disruptions.

Changes in Real Estate Industry to Adapt

Victorians are looking forward to a new and improving normal this week. While it’s another temporary transition and there’s still a long way to go, the small steps forward are providing motivation and confidence that there is light at the end of the tunnel.

The last eight weeks have encouraged many businesses to review their procedures and plans for the future and challenged a number of ways in which business has been done. As a people-based business, the real estate industry has had to adapt quickly to ensure the health and safety of buyers, sellers, tenants and staff while striving to achieve the right outcomes for buyers, sellers, landlords and tenants.

Some of the bigger changes we have seen include:

- Plan A – most properties are starting out as ‘off market’. If the home doesn’t sell in the first two weeks, it is then converted to a public campaign (Plan B).

- More properties (with realistic sellers) are transacting quickly after being listed. Many vendors are more comfortable to take the early offer now than wait for a better offer later, as it may not be forthcoming.

- More offers are being made subject to finance, with anywhere from 14-28 days for approvals.

- Many vendors are becoming more focused on settlement terms over or equal to price.

- Fewer results are being reported and won’t be available until settlement, sometimes up to six months or more later, making it harder for agents to provide reliable Statements of Information.

- Private inspections only – providing more time to inspect in detail; however, also making it harder to determine other interest in the property, possibly resulting in buyers relying heavily on information from the agent (who is working for the vendor) to make their decisions.

- Online auctions – agent feedback, generally positive. Agents able to obtain far more information about interested parties as buyers need to register to bid (including 100 points ID). However, there is also greater potential for technological difficulties (ie some buyers can’t access apps if they don’t have the right equipment, or, in many cases, information may entered in incorrectly). Less emotion involved in the bidding process. More transparent for buyers than other methods of sale such as EOI campaigns but still can’t see who you’re bidding against. Will this remain a method of sale for family homes moving forward? If face-to-face auctions return as an option, perhaps not.

- Multiple buyers – the good properties are still receiving interest and offers from multiple buyers. Some are looking for bargains; however, a larger number remain focused on finding and buying a good quality home for the longer term at a fair price.

- More EOIs (expressions of interest) – with different and sometimes changing rules, this is still a method that many buyers remain uncomfortable with.

- Interactive inspections – perhaps a good starting point to confirm early interest; however, limited to viewing what the agent wants you to see and possibly avoids some of the areas you should be focusing on: hard to get true sense of space, light etc.

- Hand sanitisers and protective gloves – something that could continue post-COVID-19 for the health and safety of vendors/tenants, as many properties for sale can have a hundred or more people through their homes opening drawers and cupboards and touching furnishings.

For buyers who had been contemplating buying pre-COVID-19 and for those who have realised they need a move up/down/sideways as a result of COVID-19, now could be as good a time as any to buy. Interest rates are low and while stock levels on the internet are low, we are seeing a high number of good quality homes for sale off market.

Below are a few questions offering insight into what could now become important when looking for a home post-COVID-19 lockdown:

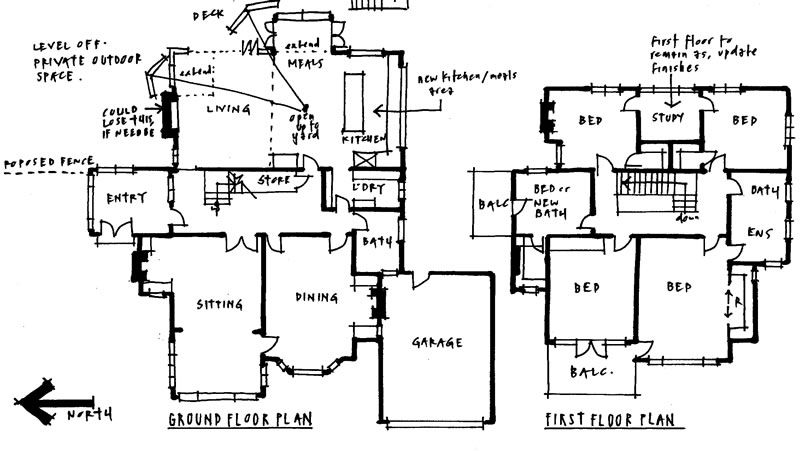

- More separated rooms – for use for work/school and quiet space for calls (Zoom etc) rather than the big open plan layout?

- Access to natural light within the home. Even more important?

- More focus on sustainability and energy efficiency with the home (to keep the bills down) eg. Self-sufficient power and water?

- Better kitchen layouts (don’t just look good but have to be functional) as cooking at home becomes more common?

- Garages to be used or double as gym areas rather just storing cars?

- Homes as the new office, functionality?

- Better options for bicycle storage – location, access, safe, dry?

- Focus on gardens within the property?

- External firepit / outdoor breakaway areas?

- Good access to a safe outdoor area close by – park, beach, safe walking track?

- Preference for houses over apartments?

One of the better properties currently listed; an architect’s view

7 Royal Crescent Armadale – Mark Harris/Fraser Cahill, Marshall White

‘Off-market’ Properties:

- Renovated, single level, 3 bed, single fronter, Armadale – circa $2m

- 1930s brick family home backing onto park, Camberwell – circa $3m

- Brick single fronter, 2 bed, 1 bath, walk to beach, Middle Park – circa $2m

- Fully renovated, family brick Edwardian with pool, Glen Iris (St) – high $3m

- Renovated timber Edwardian, 3 bed, 2.5 baths, OSP, Gardenvale – circa $2.3m

- Modern 3 level townhouse with pool, Elwood – early $3m

- 2 bed, single fronter, close to amenities, Armadale – circa $1.45m

- Funky conversion over 3 levels, Richmond – high $2m

- Large, renovated, art deco family home, Toorak – circa $7m

- 2 storey timber Victorian, 3 bed, 2 bath, Malvern – circa $2.25m

- Family home, Edwardian, approx. 440sqm, Armadale – circa $3.3m

- Well positioned, family Edwardian looking for a freshen up, Elsternwick – high $2m

- Large contemporary family home (6 bed, 5.5 bath), Brighton East – circa $3.7m

A changed world; when will it ever be a good time to buy?

How Covid-19 is Affecting the Property Market

With the Easter holidays now behind us and the first week of remote schooling under our belts, some of the earlier uncertainty has started to reduce. The media reports positive results about ‘flattening the curve’ of COVID-19 and we now have hope that some of the stage 3 restrictions may be lifted as early as mid-May.

Unfortunately, that is still unlikely to mean a return to normal as we knew it. COVID-19 has created unprecedented chaos to our lives and livelihoods. Many Australians have lost jobs and closed businesses. Some have been luckier than others, but most people are just hoping to ride the lock-down as best they can and come out, not too scathed, on the other side.

The property market has not been left untouched by the disruption, with decisions around inspections of homes changing frequently.

We can only imagine the stress vendors (particularly those who had already bought) were feeling, being told they couldn’t have any buyers through their homes. Equally, buyers who had already sold and needed to find a new home or house to rent, were concerned they might find themselves with nowhere to live, or resort to buying/renting, sight unseen.

The Melbourne property market could see a new normal emerge from this crisis.

Private sales are now commonplace. While some agents (particularly newer or younger ones to the market) have not had much experience transacting this way, there are also a number of more experienced agents who are very skilled with this method of sale. Around 30% of the homes we buy are off market/private sale, so we are comfortable and experienced operating in this new space.

How was the Property Market Before Easter

Agents were contacting us daily (sometimes multiple times a day) with new property listings. There were a few good opportunities among the pickings and some of our clients, circumstances allowing, were lucky enough to be able to purchase good homes. We noticed that buyers who had been looking for quite a while were able to benefit from the increase in stock and decrease in competition. That being said, many sales were still competitive.

How is the Property Market After Easter

New property numbers have slowed. With uncertainty in our greater economic direction, many discretionary buyers/sellers may choose to wait until a clearer path is formed.

There will, however, still be a number of buyers and sellers needing and/or wanting to buy/sell for personal ‘stage of life’ transactions. For both parties these include, but are not limited to, upsizing, downsizing, death, divorce and financial reasons. Being ‘locked down’ at home has provided opportunity for some to appreciate their houses and locations, and, for others, has helped them realise that a change may be due sooner rather than later.

When and How to Buy

Everyone seems to have an opinion about when is the best time to buy.

- Is it when the market is on the rise?

- Is it at the bottom of a crash?

- Is it when there is plenty of stock?

- Is it when there are plenty of buyers?

- Is it when the interest rates are low?

- Is it when no one else wants to buy?

- Is it when everyone is comfortable to buy?

No-one can predict when the best time to buy may be. Our focus has always been helping buyers to maximise their chance of buying the right home at the right time in their life cycle (both financially and emotionally) when the right one comes along, irrespective of market fluctuations. If it doesn’t tick key buying criteria, regardless of what’s happening in the market-place, one shouldn’t buy.

For those wanting to buy now, what is the best way to go about it?

Some properties are still being advertised online; however, a greater portion of what is available for sale at the moment is not.

One agent, who has been in the industry for a number of decades, said they are enjoying the return to private sales, as they (the agent) get the opportunity for lengthy one-on-one discussions with the buyer, enabling them to extract enormous amounts of personal information to help maximise the price/outcome for the vendor.

There is the new option of virtual tours online and interactive floorplans, but there really is nothing like inspecting something ‘in person’ – to get a proper feel for how spaces work, how natural light is captured and if privacy from other properties is or is not addressed.

We think inspections can’t and shouldn’t be avoided.

Some questions buyers considering purchasing at the moment may like to contemplate include:

- How can you find out about these homes?

- Who should you talk to?

- What is agent ownership and how could it affect you?

- What information do you have to give the agent to inspect a property?

- Will this limit your ability to inspect homes?

- Are you the only interested party?

- How much is the property?

- Is there a process?

- Is the price fair?

- Is it really for sale?

Buying in an uncertain market has the potential to be risky. Prices could fluctuate unexpectedly up or down and potentially for a number of years. But, over the years, one thing stands strong with all our clients: they want the right information, so they can make a good decision to buy a quality property that has the flexibility to work for them for an extended period of time.

A sample of current “Off market” Properties

- Freestanding Edwardian with plans for extension to create 3 bed, 1.5bath, Malvern – circa $1.35m

- Large Federation family home, large land, Malvern East – circa mid $6m

- Contemporary family home with pool, Armadale – circa early $5m

- Modern townhouse, 2 bed, 2.5 bath, DLUG, Prahran – circa $1.7m

- Brick Edwardian semi, north side, Prahran – circa mid $1m

- Californian Bungalow, near amenities, north rear, Hampton – circa $2.3m

- Landmark Victorian home on large land, Camberwell – circa $8m

- Large family home on large land, north rear, Camberwell – circa mid $4m

- Contemporary family home, renovated, Ashburton – circa high $1m

- Californian Bungalow with opportunity to improve, Hawthorn – circa $2.8m

25 March 2020 – COVID announcement

To our valued clients and the larger community,

Out of respect for those who have lost jobs or may be entering difficult financial times, we won’t be providing market updates or posting on social media sites.

While we can, we are still assisting those clients who are needing to buy homes at this time.

We understand there are vendors who need to sell and buyers who need to buy and we will do everything we can at this time to help facilitate those transactions with empathy and understanding.

In the meantime, we send wishes for you all to stay well and healthy as we work through these difficult times.

Kristen, Adam, Alex and the team at WoledgeHatt

2020 market opens with a bang

Saturday was the first auction weekend for 2020 with genuine volume. It was a mixed day, with a number of homes selling well above the quoted ranges and reserves, others passing in around or just above the range and selling after, and some with limited or no interest. However, with an overall reported clearance rate of around 80%, one couldn’t say the market was not in the sellers’ favour.

The media is now back on the ‘boom’ bandwagon.

Stock is still low and buyer numbers are continuing to grow. A number of agents have commented that there are many brand-new faces they haven’t seen before. Adding to local upgraders, they are seeing newcomers wanting to improve their location/lifestyle (suburb jumpers) and/or relocating back from overseas after working abroad.

Fear is the new market driver: fear of missing out and fear that the prices will jump another 10% this year (if you listen to the media) and maybe make your chosen suburb no longer affordable.

A number of vendors, however, are still well above the market. Looking at the weekend results this morning by price (in our key focus area), eight of the first 20 homes were passed in over $2.5 million.

Expression of interest, private sale and off-market sales seem to be popular ways for agents to sell at the moment. Fear of missing out is helping this popularity and the process provides an opportunity to sell with less transparency than a public auction.

So far this year, we have seen some homes sell for record prices, well above what may have been achieved 12 months ago and possibly above the height of 2017 prices.

Enticing quotes, however, can do the same thing as they increase the ‘real’ amount of interest by encouraging those who ‘hope’ they can afford the property to attend the inspections, providing social proof that it’s a great home.

The combination of media and quotes installs confidence for buyers that competition is going to be fierce and good selling agents are using the fear of missing out as a strategy to get buyers to pay top dollar because ‘someone else will offer it if they don’t’.

This is true in many instances. There are properties where record prices need to be paid to be the successful buyer. A more prudent question may be ‘which ones are those and why?’

Many homes are staged now and look good, but how do they really work? Understanding what you/your family needs and what the property offers is key. For example, a home has five bedrooms but the only meals area big enough for a table of six doesn’t work. Where do you plan to sit and eat when visitors come over? Or maybe you just stop having people over …

There are many components that contribute to a property being a ‘good’ property, including position, orientation, zoning, positioning on the block, layout, façade, size, improvement options, car options, to name a few. Research is the key.

Research isn’t just about the property. It can include vendor motivations, buyer interest, other properties on the market, development in the area and relevant comparable sales (often different to the agent SOI) and all of this leads back to price.

It is possible that more buyers plan to buy for longer periods before they sell again now, but the number of homes that re-present for sale after only 2-3 years is high. Life can change quickly, whether it be a work relocation, finance change, marital status change etc. and knowing what you’re buying, why you’re buying it and how much you’re paying may be helpful to avoid stressful situations down the track.

Homes that have struggled in the past don’t suddenly become good homes just because the market has improved. Sometimes good homes struggle because the vendor expectations or motivations aren’t aligned with the market at the time. Some have been improved and past issues resolved. Some have the same issues and a better market won’t change them.

In a market with limited stock and plenty of hype, it can sometimes be harder to make a good decision as it’s easy to get caught up in the emotion of it all. Agents are counting on it and using it to get record prices.

Highlights:

- 108 Sackville Street Kew (James & Charlie Tostevin, Marshall White) – renovated ’70s split level home on south rear 921sqm (approx.), initially quoted $4.1-4.5m, sold for an undisclosed amount over $5m

- 9 Spring Street Sandringham (Nick Jones/Amanda Thomson, Hodges) – a modern home on 846sqm (approx.) in a weaker part of Sandringham, quoted $2.2-2.3m, sold for $2.68m

Properties we like going to auction this weekend:

9 Talbot Avenue St Kilda East – Limor Herskovitz/Nikki Hanover, Garry Peer

8 Lawes Street Hawthorn – Sam Wilkinson/Garrick Lim, Kay & Burton

“Off Market” Properties:

- Two storey family home with pool, Glen Iris – circa high $2m

- Period home, Central Park district, Malvern East – circa $4.5m

- Single level Edwardian with north rear, Malvern East – circa $3m

- Large family home on approx. 827sqm, Canterbury – circa $3.7m

- Edwardian style, newer build, family home, Sandringham – circa mid $3m

- Family home on large land approx. 1,020sqm, north rear, Glen Iris – circa $4m

- Victorian home, approx. 702qm, west rear, Hawthorn – circa high $4m

- Timber Edwardian on approx. 430sqm, Hawthorn – circa high $2m

- Family home/land, walk to beach, approx. 651sqm, Brighton – circa early $3m

- Family home on good land size, Malvern – early $4m’s

Auction Spotlight

19 Myrtle Road Hampton

Adam Gillon from Buxton had a good crowd and keen bidders to work with at the successful auction of 19 Myrtle Road Hampton

The home at 19 Myrtle Road Hampton delivers a great lifestyle location for families with a north rear. The home itself is a little quirky in its layout, with the original timber home extended out and down at the rear for added living, plus a master suite upstairs. Perhaps these aspects, plus a quote range of $1.85-1.95m had people spooked when it originally went to market April/May 2019. At that time, the auction resulted in a pass in, with nothing but a vendor bid placed. Less than a year later with a quoted price of $1.7-1.8m, there was a much stronger level of interest in the property. A young family opened the bidding at $1.7m, followed by a second party and the two traded offers to swiftly take the property on the market at $1.85m. Increments slowed to $5k, but came so fast that a third bidder entering at $1.93m was soon left behind again. Both bidders were now clearly trying to slow things down, dropping to $1k offers, but not prepared to give up the home for their families. The second bidder eventually outlasted the competition with a solid price for the offering of $2.00m.

108 Sackville Street Kew

Marshall White’s James Tostevin in front of a good-sized crowd for the quickfire auction of 108 Sackville Street Kew.

Interesting property this one with plenty of questions marks…..south rear, no car garaging, end of T-intersection…But it is a ’70s modern home of some regard – The Buckle House, by Architect Kenneth Edelstein, which has been tastefully updated inside and has a great feel.

Word in the industry was this was going to be well supported by the market on auction day, and the rise of the quote during the campaign supported that. In front of about 100 people, auctioneer James Tostevin looked for an opening bid of $4.2m but was ‘upped’ by the first bidder who confidently bid $4.3m. Then the auction was off and running with another bidder joining in and the property was announced on the market at $4.6m. A third bidder joined in around the $5m mark but didn’t have enough steam to continue much of a fight, and the property sold under the hammer for a very healthy $5.06m, to the starting bidder. Vendor would have to be very happy here who last bought the property back in 2013 for just over $3.3m.

Mood positive for a good start to 2020

Welcome back to the 2020 Melbourne property market.

It was the first solid weekend of inspections and, despite the weather, which was anything but predictable, expectations didn’t sway, with a continuation from where we concluded in 2019 – low stock, plenty of people out at inspections and not enough of the right houses to choose from.

Compared with 12 months ago, agents on the weekend had a spring in their step, with the knowledge that the number of buyers looking exceeds the stock, providing a level of confidence that their properties will sell on auction day if vendor expectations are fair. The mood and vibe was definitely up-beat.

Among the available stock, there are a few treasures that will no doubt be highly fought over. For a number of these properties, vendors have chosen not to auction their homes, deciding to sell via private sale, expression of interest and even extra quietly off-market (direct agent connection to very qualified buyers, no blast emails or texts to the mass database).

One could ask why someone might want to sell quietly when the stock is low and they have an in-demand product?

There are many reasons, including: a number of vendors don’t have the time or inclination to prepare for a public campaign, some don’t want their private lives on display and some don’t want their neighbours/family/friends to know they are selling. Advertising, too, is costly.

With increasing global uncertainty posed by events such as the coronavirus, Brexit and the Hong Kong unrest, we may see even more families wanting to return or migrate to Australia and, more specifically, Melbourne, as it offers a safe place to raise a family. This adds to the increased demand for the limited homes available.

All the signs suggest that buying is going to get harder, not easier, at least in the short term.

It may be necessary to consider greater compromises if wanting to buy within certain suburbs or within specific distances to amenities. It could be equally important to wait and not rush in to buy what’s there, just because that’s all there is available. Why not think about buying a B-grader that can turn into an A-grader?

Having the right information and advice at hand to make a good decision is becoming more prudent to successfully navigate the Melbourne property market. With fewer opportunities, missing a potentially suitable one is likely to be taxing both financially and emotionally.

Get in touch with an experienced buyers advocate melbourne to get yourself one step ahead of the competition.

Contact us to get started today.

Some of the better properties currently for sale via EOI; an architect’s view

179 Were Street Brighton – Ben Vieth / Andrew Campbell, Marshall White

16 View Street Hawthorn – Hamish Tostevin / Chris Barrett, Marshall White

‘Off-market’ Properties:

- Period home, 3 bedrooms, very central, approx. 390sqm, circa $1.5m – Elsternwick

- Two storey terrace, 3 beds, 3 baths, approx. 267sqm, early $3m – St Kilda

- Approx 835sqm land with permits for 2 townhouses, circa $2.4m – Sandringham

- Original Californian Bungalow extended over time, around $2m – Hampton

- New home site, approx. 635sqm, north rear, circa $1.75m – Black Rock

- Brick period home, north rear, dated renovations, high $2m – Hampton

What did we learn during 2019 about the Melbourne property market?

As 2019 comes to an end, buying a home in one of the world’s most liveable cities remains a challenge.

We believe a combination of factors have contributed to this.

The first half of the year was cautious, as vendors and buyers waited for the outcomes of both the Royal Commission into banking and the Federal election.

Both these decisions provided a much-needed confidence injection for buyers to transact and, off the back of a long winter break, they found themselves competing fiercely for the limited supply of good properties.

Second-tier banks such as ING, Suncorp, Bendigo and Macquarie, eager to increase their market share, worked proactively with buyers to fund and improve their buying capacity, resulting in more buyers ready to transact and at higher levels than earlier in the year.

Unlike 2017, where it felt like buyers were prepared to stretch on almost every property for sale (even those with multiple compromises), discretion has remained for the moment. This has contributed to a larger gap in the prices between the ‘A’ graders and others.

We are also now seeing a number of homes sell above 2017 prices.

The good properties (well located, functional, ready-to-move-in homes) remain few and far between, which has contributed to a sense of FOMO (fear of missing out).

We believe low stock levels are here to stay. Vendors who enjoy where they live are tending to stay if the location works.

Where it may have been more common in the early 2000s to move every 5-7 years, rising prices have also contributed to higher stamp duty taxes. $110,000 stamp duty on a $2 million purchase is likely to cover a new kitchen/bathroom upgrade for most.

The typical property cycle of the past has also changed.

Where, when a buyer bought, they generally replenished the market with something to sell, we are seeing less of this happening, as many buyers now are new to Melbourne with nothing to sell.

Our early expectations for 2020, at least until Easter, are that if the good-quality stock is in low supply, buyers will continue to face challenges finding and buying the right home.

2020 will be the prime time to get in contact with a professional buyers advocate if you are looking to snap up a property. Get in contact with WoledgeHatt Buyers Advocates and start your journey today.

Highlights:

- 56 Berkeley Street Hawthorn (Tony Nathan, Woodards) – a basic original house on just under 700sqm in a signature street and within illustrious company, quoted $2.5m plus, sold strongly for $3.66m

- 32 Adelaide Street Armadale (Justin Long/Fiona Counsel, Marshall White) – two storey, renovated semi attached home in a quality street close to High Street shopping strip, quoted $2.7-2.97m, sold for $3.35m

- 37 Page Street Albert Park (Simon Gowling/Max Mercuri, Greg Hocking Holdsworth) – renovated two-storey period home with pool and secure OSP for one car, sold for an undisclosed amount above $4m

- 38 Wright Street Bentleigh (Trent Collie/Nick Renna, Jellis Craig) – early 2000s modern home, ready for an update in places, backing onto Allnutt Park, quoted $1.95-2.145m, sold strongly for $2.52m

- 3 Bamfield Street Sandringham (Stephen Wigley/Kylie Charlton, Hodges) – a corner square block of 601sqm, with a large but dated Californian Bungalow ready for work or possible replacement given the ‘A’ grade location, quoted $2.35-2.45m, sold for $2.62m

One of the better properties scheduled for auction on 14 December 2019; an architect’s view

58 Bamfield Street Sandringham – Greg Costello/Justin Hocking, RT Edgar

“Off Market” Properties:

- Ground/whole floor apartment, one of two, 3-2-2, South Yarra, early $3m

- Single fronted Hawthorne Brick, 2 bed, 1 bath, Windsor, circa $1.3ms

- Renovated Edwardian family home, 4-2-2, Brighton, circa $3.25m

- Renovated Edwardian, close to Church St, 4-2-2, Brighton, circa early $3m

- Edwardian two storey family home w. pool, 4-2-2, Caulfield North, high $2m

- Renovated home, good location, pool, 4-2-2, Hampton, circa $2.7m

- Modern Townhouse, 4-4 & basement garage, Hawthorn East, circa high $3.9m

- Renovated & extended period home, 3-2.5-2, Hawthorn, circa $5.5m

- Brick period home seeking renovation, approx. 530sqm, Malvern East, circa $3m

- Edwardian brick semi, extension plans, approx. 220sqm, Prahran, circa $1.4m

Auction Spotlight:

25 Sims Street Sandringham

The crowd delivered five bidders at the successful auction of 25 Sims Street Sandringham

25 Sims Street Sandringham is one of those uncut gems that offers a multitude of possibilities. The original Edwardian home could be brought back to life with an all-encompassing renovation. Without restrictive overlays, however, the home was also appealing to developers, keen to take advantage of the north rear and ‘A’ grade position.

Paul Bond headed up the Hodges team throughout the campaign and on auction day. Neighbours turned out in force to see what the property’s future might bring, as well as a strong attendance of buyers. Customary silence followed the preamble, making Paul place a vendor bid of $1.8m which kickstarted two parties bidding. Announced on the market in the mid $1.9 millions, a third bidder entered proceedings as bidder one stepped out. Bidder two (a young couple, planning on renovating the existing home) stayed strong, now trading bids with a fourth party who offered $1000 each time to their $9k. They managed to hold off this bidder; however, when a fifth party joined the auction at $2.1m, their capacity was eventually exceeded, the property knocked down for $2.221m to the successful party.

28 Elphin Grove Hawthorn

Scott Patterson had the sun shine on the garden setting of his auction at 28 Elphin Grove Hawthorn.

A small crowd of about 20 people gathered in the tranquil backyard to witness this auction. Well located and on good land (approx.. 855sqm), the home had been tastefully renovated. The flats in the street and lack of garaging had the potential to limit interest, however, in a market with limited stock three bidders took stage to fight it out. Auctioneer Scott Patterson looked for an opening bid and, after a bit of time, found one at $3.1m. Not long after, bidder two came into play and things tracked along quite slowly with mainly $5k bids. At $3.46m, the property was announced on the market, with bidder three coming into play as bidder two dropped out. Ultimately bidder one prevailed with the final price settling at $3.701m. A fair result for buyer and seller alike.

Will we see another Super Saturday this year?

Saturday was the first test of the rising Melbourne market under the pressure of volume and, in general, it held up surprisingly well.

We feel the ‘in demand’ quality homes, such as well-located single-storey homes, downsizer homes, large family homes and fully renovated homes are still in low supply, helping fuel strong prices for the ‘A’ graders.

Homes on the weekend that fell into this category generally sold well, if the vendor expectations were still fair. Interestingly, we are starting to witness a number of vendors whose expectations are well above the peak of 2017.

A buyers advocate can help you navigate the Melbourne property market and identify the property that suits your needs.

Get in contact with Woledge Hatt Buyers Advocates today and prepare yourself to compete in the market.

An example of this was 44 McKinley Avenue Malvern

It sold in 2017 for $3.19 million on 24 June 2017 and auctioned again on the weekend. Quoting $3.1-3.3 million, competitive bidding saw the buyers take the price to $3.31 million before it passed in. This is a figure 3.5% higher than that achieved in 2017. The asking price is now $3.45 million.

With the countdown now on until Christmas, there are only seven key weekends left for 2019. If the right property is not out there, buyers may need to consider a new strategy to carry them into 2020.

We see too often at this time of year buyers making emotional decisions, rushing to buy anything so they can start the year afresh, only to find the home not ticking the key boxes and the homes presenting for sale again within a year or two.

Highlights:

- 25 Kooyongkoot Road Hawthorn (Scott Patterson/Judy Balloch, Kay & Burton) – approx. 1254sqm land, a comfortable storey period home, however, really ready for the next update, quoted $7-7.7m, sold under the hammer for an undisclosed amount under $8.2

- 12 Wingan Avenue Camberwell (Nick Whyte, Nelson Alexander) – approx. 602sqm backing onto the park, original home, predominantly land (stca), quoted $1.5-1.65m, sold for an undisclosed amount in excess of $2.1m

- 5 Milton Street Camberwell (Hamish Tostevin/Désirée Wakim, MarshallWhite) – functional family home saw five bidders push the price $500,000 over reserve, selling for $3.85m

- 5 Henry Street Highett (Paul Sibley/Natalie Alesi, Buxton) – modern family home nestled between the railway and the highway, quoted $1.7-1.8m, sold before auction for $2.07m

- 90 Stanhope Street Malvern (Adam Cashmore/Mark Sproule, The Agency) – the large renovated family home was well attended at the Thursday evening auction. Quoted $4.8-$5.28m, three bidders pushed the price above $5.5m

- 12 Fawkner Street South Melbourne (Justine Harris/Mark Wridgway, RT Edgar) – approx. 334sqm, south facing rear has sold after nearly 200 days on the market for $2.65m or $7,934sqm

“Off-market” Properties

- Townhouse, 2 bed, 2 bath, 1 OSP, rooftop terrace, South Yarra – circa $1.7m

- Federation with modern extension, 4 bed, 4 bath, DLUG, Glen Iris – circa $5m

- 2 street frontage, no heritage, approx. 770sqm, Elsternwick – circa $3.3m

- Period front, modern rear, 4 bed, 3 bath, approx. 943sqm, Kew – circa $3.5m

- Modern upside-down home overlooking park, Prahran – circa $3m

- Period home, original condition, no Heritage overlay, approx. 815sqm, Kew – Circa $2.7m

- Freestanding townhouse, recently updated, Brighton – circa $1.85m

- Single level villa between beach and shops, Hampton – circa $1.7m

- Family home opposite park, single level, pool, Hampton – circa $1.95m

Auction Spotlight

A large crowd at the Thursday night auction showcased the capacity for entertaining at the rear of 90 Stanhope Street Malvern.

The original Federation home has been modernised and extended to deliver a large family home with clever zones and storage throughout. The outside entertaining area and pool are well positioned to maximise afternoon sun.

Adam Cashmore and Mark Sproule headed up The Agency team, with Adam placing a vendor bid of $4.8m to start off the auction. Two bidders steadily took the offering up past reserve around $5.3m. At this point one stepped out, a third entered and very briefly a fourth. Bidder one and three continued in varying smaller increments, with the latter eventually outlasting everyone, securing the home for a little over $5.5m.

At WoledgeHatt Buyers Advocate in Melbourne, our experienced team will work with you to ensure you buy the right property that meets all your needs, at the right price.

Contact us to get started today.

Is this the new normal? We think so.

Buying good homes in Melbourne is about to become even harder.

Why do we say that?

We think the market we are currently in (whether prices are up or down) is the new normal and will be for at least the next few years while interest rates are low.

Stock levels are unlikely to increase significantly. A lot of what is out there is now very different to five years ago. Apartments and townhouses are making up a larger percentage of the offering. The roads are getting busier and lives are getting busier.

Traditionally, the market in Melbourne was a local one. There were more seller/buyers. That proportion has dropped significantly. More buyers are now coming from overseas and interstate or are first home buyers or are buying investment properties – hence they do not have anything to put back into the market.

If we compare the same weekend five years ago, there were 189 reported sales in the Bayside, Port Phillip, Stonnington, Glen Eira and Boroondara council areas, with 91 apartments/townhouses sold, or 48% of the overall offering.

Last weekend, there were 95 reported sales (half the amount of five years ago) of which 55 were apartments/townhouses, making up 57% of the overall offering and nearly 10% more than five years ago.

For families wanting the traditional family home and a backyard for the kids, the options are decreasing.

As a vendor lucky enough to own one of these properties, unless you need a better/different location, bigger or smaller home/land and can’t renovate, the desire to move is unlikely to be strong.

As a buyer, fewer good options is likely to result in continuing increased competition.

We are also seeing buyer frustration around quoting.

Many homes are now selling well above the quote range. Even if the vendor is a seller in the range, most buyers (for the good ones) are now prepared to bid comfortably beyond the advertised prices if they want to out-bid their competition.

We do not think that means you should just keep bidding because you can. In 2016 and particularly 2017, many buyers used this tactic; however, the recent slump saw a number of those buyers become sellers for a lot less than they had paid.

The property has to tick the right boxes, due diligence needs to be thorough and we believe there are stop limits for most properties.

We understand quoting can be harder to manage in a rising market; however, there are a number of more recent homes that could be included in Statement of Information quotes and yet are not because agents have more recently chosen to not disclose the amount at all when reporting the property sold.

While eventually the property prices will become public, usually once the transfer has been registered through the Titles Office, it is often too late by the time they are released post-settlement. A lot of this information is known within the industry but not outside it.

In the meantime, the frustration continues to build, and the importance of making good decisions through accurate information and intel as a buyer is greater than ever.

At WoledgeHatt Buyers Advocate in Melbourne, our experienced team will work with you to ensure you buy the right property that meets all your needs, at the right price.

Contact us to get started today.

One of the better properties scheduled for Auction on 26 October; an architect’s view

44 McKinley Avenue Malvern – Darren Lewenberg/Grant Samuel, Kay & Burton

‘Off-market’ Properties:

- Double fronted Edwardian looking for a freshen up, north rear, Malvern – circa $2.7m

- Modern two storey family home, Malvern – circa mid $4m

- Mediterranean inspired Townhouse, 3 bed, 3 bath, DLUG, Toorak – circa $4.75m

- Single fronted Victorian, renovated, 3 bed, 2 bath, OSP, Armadale – circa $2.4m

- Fully renovated & extended Edwardian, pool, approx. 577sqm, Malvern East – high $3m

- Edwardian brick home, extended some years back, pool, Elsternwick – early $2m

- Single fronted, two storey, renovated Edwardian, Elwood – early $2m

- Semi-attached brick Edwardian, 3 bed, 1 bath, Balaclava – circa $1.4m

- French provincial family home, automated, north rear, Brighton East – circa early $3m

Auction Spotlight:

A good sized crowd watched Mark Earle from Buxton successfully auction off 8 Heath Street Sandringham.

The family sized Edwardian at 8 Heath Street Sandringham had gathered solid interest both during the campaign and at the auction on Saturday. The 45 feet frontage limited the stately nature of the front rooms to an extent, but the land’s depth (delivering approx. 792sqm) and extension, carried out quite some years ago, do deliver a solid family package. A good-sized studio in the rear offers further flexibility. While on the south side of the street, the street itself is regularly a popular choice for families.

The campaign had been headed up by Charles Darlow and Scott Hamilton from Buxton, quoted at $2.45-2.55m.

Following Mark Earle’s preamble, the auction swiftly got underway with a $2.45m bid. A second bidder entered and the two traded offers before bidder 1 stepped out and was replaced by a third party. The home was declared on the market at $2.59m. Bidder two occasionally tried to gain the upper hand with larger jumps in bids and was eventually successful, securing the home for $2.73m.

Stronger market seems to be the new norm, for now.

The third quarter Melbourne Market for 2019 has been anything but predictable.

We have seen consistently high clearance rates, above 70%, since July and very low increases in stock levels. Why? Because there are more people wanting to buy in Melbourne than people wanting to sell.

Many vendors of well-located homes (close to shops, schools, transport etc.) are choosing to renovate, update or extend rather than sell.

Stamp duty is also becoming more of a consideration for seller/buyers (5.5% in Victoria).

A $2 million property will attract stamp duty of $110,000, therefore if the location works, why move? Often an updated kitchen and/or bathroom can be enough to satisfy any restless thoughts that it’s time for a change.

Combine this with low stock and the uncertainty that it may take a long time to find something to buy and it can make sense to remain where you are and improve what you have.

That is why we believe it is more important than ever to buy right first time, with a home that has the flexibility to grow with you over a number of stages of life, from starting out as a younger couple/family through to downsizing. A quality buyers advocate can guide you in finding the one.

We think the current market is starting to feel more like the late 2016/2017 marketplace, where buyers were desperate to buy anything just to get into the market, although currently we still see properties with identifiable issues (internal and/or surrounding) finding this new market tough.

Quotes have become more confusing for buyers.

Many of the current vendors selling signed up before the market was showing signs of improvement.

Their motivations have been for genuine reasons (such as relocation, divorce, death etc.) and their quotes have been in line with past results, yet talk of underquoting has become the common topic of conversation again and we are seeing many buyers left disillusioned, spending money on building inspections and contract checks, as well as investing a lot of their time and emotion into properties to find they were never in the game in the first place.

For many properties selling at the moment, they are the only option available for buyers and some are achieving high prices as a result. If it meets your needs, that is great; however, we think it is equally important to consider how the property will stand up not only in the current competitive market but also if the market were to change back again, just in case you have to sell unexpectedly.

Contact the professional team at WoledgeHatt Buyers Advocates to kick start your journey.

Highlights:

14 Parnell Street Elsternwick (Daniel Ashton/Ben Gerrard, Biggin & Scott) – quote $2.6-2.86m, a renovated period home with north rear – sold for an undisclosed amount under $3.2m

1 Chavasse Street Brighton (James Paynter/Sam Paynter, RT Edgar) – quote $2.1-2.3m, fairly original but very clever home built in 1971, close to Church Street – $2.54m

7 Howitt Street South Yarra (Madeline Kennedy/Nicholas Brooks, MarshallWhite) – quote $2.75-2.95m, a renovated single fronted home – $3.6m

29 Bolton Street Beaumaris (Romana Altman/Jennifer Hine, Buxton) – quote $1.5-1.59m, fairly original 70s home (with mid-century features) on 791sqm – $2m

A property we like, coming up in October:

8 Heath Street Sandringham – Charlie Darlow/Scott Hamilton, Buxton

“Off Market” properties

- Fully renovated Edwardian family home, Malvern East – circa high $3m

- Single level/fronted Victorian, renovated, Armadale – circa $2.4m

- Double fronted, single level Edwardian, renovated, Malvern East – circa high $2m

- Double fronted Victorian, dated renovation, north rear, Armadale – circa mid $2m

- Edwardian weatherboard, original on approx. 498sqm, Elsternwick – circa $1.8m

- Single fronted Victorian, 3-2-0, approx. 253sqm, Malvern – circa $1.75m

- Family home on approx. 1,650sqm, Beaumaris – circa $4.5m

- Family home in the Castlefield Estate, approx. 900sqm, Hampton – circa mid $3m

- Conveniently positioned Townhouse, 3-2-2, Brighton – circa $1.75m

Auction Spotlight

Bill Stavrakis from Biggin & Scott had two bidders fight it out for 14 Parnell Street Elsternwick, with neither wanting to let the home go.

Only a few years ago, 14 Parnell Street was a little single-fronted weatherboard home with a dated extension at the rear. With its more recent full renovation and extension, it has become a well-thought-through family home. Children have their own zone with two bedrooms, bathroom and retreat upstairs. The master suite, a study and two further living zones make up the ground floor, plus a bonus studio at the end of the north-facing rear garden, behind the pool. The spacious laundry/mud room and butler’s pantry are ideal for families, as is the BBQ area flowing off the informal living at rear. Perhaps its only shortcoming is the lack of covered car parking at front, which would ruin the pretty façade.

A large crowd was spread around the rear open plan kitchen and living zone for the Bill Stavrakis-led Biggin & Scott auction. After the customary delay to build anticipation, Bill got things started, but was made to wait by potential bidders in return. Just when it seemed like there may be no bidding on the home, a lady came forth with an offer of $2.55m.

As is often the case, the second bidder was standing almost beside her and the two traded swift $50k bids to reach $2.9m in a blink. Daniel Ashton quickly dashed off to confer with the vendors while the auction continued, coming back at $2.95m to declare the home on the market. The announcement certainly didn’t have the desired effect, as bidding almost stopped, then crept up in painful $5k amounts. At $2.985m bidder 1 declared she was out and bidder 2 looked to have it in the bag. At the last gasp, a relative of bidder 1 jumped in, clearly not willing to let the home go for her family. She was determined to win the property, but so was bidder 2. With bids of $1k or $4k the two traded blows, hoping to outlast the other. Often it looked like one was giving up (mainly bidder 2), but Bill cajoled and prodded until another bid was placed to restart the process. The first party was getting extremely frustrated with this, threatening to stop bidding, but then again not wishing to give up the home. She eventually outlasted the opposition, securing the property for $3.175m. Around 100 bids were placed throughout the auction. A very strong end result for this part of Elsternwick.

2 Little Boundary Street South Melbourne – Simon Graft, RT Edgar – opened at $1.4m, 5 bidders, sold strongly for $1.611m.

Buyer demand driving stronger than expected market.

The market continues to perform strongly, on low stock levels, since it resumed after the Winter break.

Clearance rates have been solid and many properties have seen multiple bidders again, particularly the good ones (ie well located, orientated, functional floorplan, renovated etc).

There are a number of buyers in the market who have been waiting since this time last year to buy a home. Some have been successful over the past couple of months, others are still searching.

Adding to the volume are a number of new local buyers as well as expat Australians, currently living/working overseas, wanting to return home and ready to buy.

Buyers are also more ‘buy fit’ now than they were when searching 12 months ago, particularly when it comes to finance.

They are aware the process could potentially be tedious and time consuming as finance companies dissect in detail living expenses and capacity to repay loans.

Speaking with a number of mortgage brokers, second-tier banks, such as ING, Macquarie, BankWest etc, are also eager to increase their residential mortgage portfolios, providing good opportunities and help for buyers requiring finance, in addition to the major four.

We believe low stock is still the major driving force for the improved results and increased clearance rates.

There is still a reluctance for vendors to sell if they don’t have to.

Two of the three most common reasons for vendors to sell are divorce and death (or aging vendors moving into care facilities). The third, debt, really hasn’t resulted in vendors needing to sell and is unlikely to be an influencing factor in the short term if interest rates remain low, unless job security becomes more unreliable.

Discretionary selling to upgrade or downsize has been put on hold for fear they may not find anything to buy after they sell.

A number of these potential vendors have made the decision to renovate/extend instead, particularly if their properties are well located to the most desired amenities.

The sudden change in the market has also seen an increase in price confusion for buyers. With the high and low results over the last 6-12 months, buyers are finding it harder to determine where the price may really be and why.

Quotes are also becoming more confusing.

Many buyers (in retrospect) feel like the quotes are too low, yet others too high. The quote is, however, only one piece of the puzzle and takes into consideration not only the recent sales but also the vendor’s expectations and motivations.

Take, for example, a home quoted at $2-2.2 million. Bidding commences, the auctioneer announces the property ‘on the market and selling’ at $2.18 million and competitive bidding results in a final sale price of $2.45 million.

This is unfortunate, however, the right research prior to the auction could have disclosed this, potentially increasing your chances of being the buyer or reducing the disappointment of missing out.

It could also save three weeks of hope and excitement wanting to buy a property you could not afford and miss other opportunities in the meantime. Working with a local buyers advocate can help you foresee these circumstances and help you make the right decisions.

The low stock is also encouraging buyers to jump suburbs for the ‘right house’, particularly if the proximity to amenities is still convenient. These buyers can sometimes bring higher budgets to the auction with local buyers needing to decide whether they wish to compete, sometimes well above what may make sense for the area.

Making good decisions at the moment is the key to good purchasing; in particular, knowing what you are buying and how it will work for you.

We have heard of multiple underbidders, disappointed in their misses, very quickly buying lesser quality (often off-market) properties, with little or limited due diligence and understanding of price. The good agents are taking advantage of their disappointment and emotion and achieving some strong results for vendors.

When buying, our clients know in advance what they’re buying (due diligence), why it suits their needs and have in hand a full price analysis, before auction day or before making an offer, so they can make an informed decision.

Too often we see buyers purchase a property, only to find it up on ‘realestate.com’ within two years, usually for a lot lower price. WoledgeHatt can help you avoid these situations, contact us today.

Two properties recently purchased in Brighton East were back up for auction this month:

- 14 Regent Street Brighton East sold on 1/7/18 for $3 million. Approx. 923sqm, south rear with dated 70s home. Approximately one year later, a competitive auction saw the property sell for well over $100,000 less

- 17 Plantation Avenue Brighton East sold on 24/2/18 for $2,420,000. Approx 652sqm, north rear, basic cream brick home. Approximately 18 months later, it has sold for an undisclosed amount, but a loss of more than $100,000

Some of the better properties scheduled for Auction on 14 September; an architect’s view

42 Dixon Street Malvern – Carla Fetter/Andrew McCann, Jellis Craig

1 Chavasse Street Brighton – James Paynter/Sam Paynter, RT Edgar

‘Off Market’ Properties

- Single fronted timber Victorian, 3 bed, 2.5 bath, approx. 251sqm, Malvern – circa $1.75m

- Californian Bungalow, close to beach & shops, 4 beds, Sandringham – circa $2.5m

- French Provincial new build, 4 bed, 4 bath, DLUG, Hawthorn East – circa $6.5m

- Victorian double storey terrace, unrenovated, approx. 173sqm, Richmond – circa $1.9m

- Art Deco semi attached, fully renovated, 3-2-2, approx. 393sqm, Malvern East – circa $1.75m

- Single fronted Victorian, 3 bed, 1 bath on approx. 228sqm, Malvern – circa $1.75m

- Weatherboard Victorian, updated some years ago, approx. 567sqm, Brighton – circa $2.7m

- Two storey family home, 4 bed plus study, 3 bath, DLUG, Caulfield South – circa $1.9m

- Victorian brick home, fully renovated, 4 beds, Hawthorn – circa $4m

Auction Spotlight

Justin Long from Marshall White orchestrating proceedings at the auction of 22 Bailey Avenue Armadale.

22 Bailey Avenue Armadale offered a single-level brick Edwardian that has undergone a classy renovation. The home is well positioned to the shops and restaurants around Glenferrie Road, as well as a multitude of transport options. Sitting on approximately 640sqm with a west rear, the home gets good afternoon light, while being hampered earlier in the day with a block of apartments to the north.

A decent crowd of more than 50 people gathered in the garden for the auction led by Justin Long with Fiona Counsel. As per his customary style, Justin opened with an instant vendor bid of $3.05m. An extended silence ensued from the crowd, until a bid of $3.075m was finally received. A second bidder jumped in before bidder one placed his second and final bid. “Was the home on the market?” Even with a negative answer, bidder three entered the competition, bidder two countered, again the question of “Is it on the market?”. Justin gave everyone some thinking time by going inside to speak to the vendors. The break did nothing to speed things up, with bids dropping to 10k and repeated calls of whether the home was on the market. Eventually bidder three stated she would not bid again if it was not on the market. Justin again went in to speak to the vendors, taking quite some time to do so. Bidder three did place one more bid even though the home was not on the market, bidder two countered and the home was passed in to him at $3.27m. The home sold shortly after for a slightly higher amount.